Today’s Market Trend

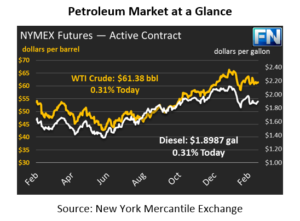

The oil complex made small gains Thursday supported by a constructive IEA report. Crude prices gained 24 cents yesterday closing the day at $61.19. This morning, crude remains slightly higher gaining a mere 19 points (.31%) to trade at $61.38 currently. Despite strength in prices this morning, crude is set to end the week lower overall.

Refined product prices are mostly flat this morning, following a day of minimal gains. Diesel gained 58 points yesterday to close the day at $1.8929. This morning, diesel has risen by another 58 points (.31%) and is currently trading at $1.8987. Gasoline increased by 42 points yesterday, closing at $1.9248. However, gasoline could not hold on to its minor gains and is trading 9 points (.05%) lower this morning at $1.9239.

The IEA released its Monthly Oil Market report yesterday. Global demand is expected to be 99.3 MMbbls per day, an upward revision of 100,000 barrels from February’s report. Global supply expectations also increased by .7mb/d due to higher non-OPEC output to 97.9 MMbbls per day. The increase in demand provided some support for the oil complex, however, the impact on prices was minimized by the expected increase in supply. Global prices fell at the beginning of February, but recovered and stabilized near the end of the month. WTI-Brent spreads continue to narrow while Brent prices have averaged $67/bbl in 2018.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.