Today’s Market Trend

Markets are enjoying a slight rebound this morning, as investors are beginning to “buy the dip” in prices. Most financial markets saw heavy losses last week, suggesting the price change is a reaction to potential interest rate hikes rather than changes in any underlying fundamentals. Because the fundamentals still point to higher prices, expect the market to jump higher once the financial market correction finishes.

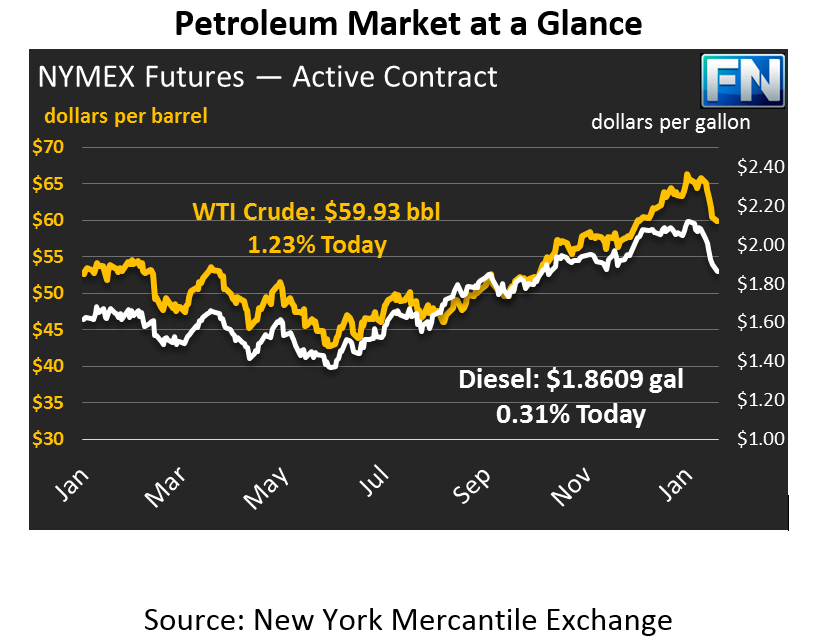

WTI crude oil prices today are back in positive territory, rising $1 since closing on Friday to surpass the $60/bbl level once again. Prices remain on the upward mend, and have are currently trading at $59.93, up 73 cents (1.23%) this morning.

Refined products have also recovered some of last week’s losses, but by a much smaller percent than crude. Diesel experienced heavy losses during Friday’s trading session, giving up over 5 cents to close the day at $1.8551. Diesel has gained back 58 points (.31%) this morning and is currently trading at $1.8609. Like diesel, gasoline saw steep losses as well, ending the day at $1.7002, over 4 cents from its opening price. Gasoline is currently trading at $1.7047, a mere increase of 45 points (.26%).

OPEC’s Monthly Oil Report and the Baker Hughes Rig Count are main topics of focus for the market this morning. OPEC reported a drop in crude oil production by 8.1kbpd in January, led by a major decline in production from Venezuela due to ongoing geo-political issues. Rig counts rose by 26 for the week ended February 9th, bringing rig counts to a 2 year high of 791. The Permian basin led the increase adding 10 rigs to the final count.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.