Today’s Market Trend

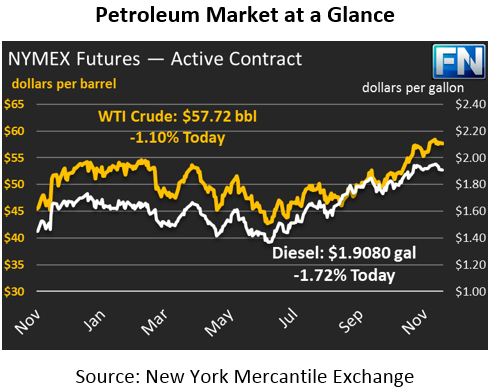

After a significant run in prices on Friday that added nearly $1.00 to crude prices, markets are falling back in line with their previous trends. Traders were enthusiastic on Friday that OPEC and Non-OPEC producers agreed to a deal extension, but that enthusiasm has faded today as reality sets in. After rising to $58.88 and backing down on Friday, prices this morning are down 64 cents (1.1%), currently trading at $57.52.

Diesel and gasoline prices both felt the same pop of prices on Friday, with diesel fuel spiking 6 cents and gasoline rising 4 cents before ending the day with 4-cent and 1-cent gains, respectively. Both products are heading to lower territory this morning. Diesel prices are currently down 3.3 cents (1.7%) at $1.9080. Gasoline prices are seeing slightly larger relative losses, down 3.3 cents (1.9%) to $1.7416. Gasoline has been in a free fall since last week, with prices giving up roughly 8 cents so far since last Monday.

Markets have calmed somewhat following OPEC’s extension announcement, though market conversations continue to showcase the importance of the deal. The announcement that Libya and Nigeria will join the agreement helped support prices, since those two countries were previously excluded from the deal and had large swings in productivity. Russia sought the option to exit the deal in 2018 if markets return to 5-year averages, and the organization as a whole will review in June whether to stay the course of cuts. While talks of tapering off the output caps were called “premature” by some officials, it’s possible that production limits could be slowly raised to help markets re-adjust to normal OPEC production levels.

The federal investigation to the Keystone Pipeline leak a few weeks ago has revealed that the cause could be systemic to the pipeline. The issue was found to be a weight that prevents the pipeline from moving, which caused damage to the pipeline. The finding could potentially lead to a full investigation of the full pipeline to determine whether the weights are putting other locations in jeopardy. Additionally, if regulators determine the issue must be corrected for all new pipelines, engineering plans for the Keystone XL pipeline, just recently approved to be constructed, could need to be re-made. That could add new delays to the pipeline, which would have helped lower WTI crude oil prices by making it easier to deliver oil from Canada to the Gulf Coast.

After a significant period of high refining margins, 3:2:1 crack spreads (the rough margin a refiner makes from turning three barrels of crude oil into two barrels of gasoline and one barrel of diesel) opened at its lowest level since early-July. Currently, the spread is trading at $16.90, below its 3-year average level. Lower refining margins mean less incentive to produce gasoline and diesel. If the 3:2:1 continues its downward trend, supplies of fuel could begin to decline, leading to higher prices down the road.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.