Today’s Market Trend

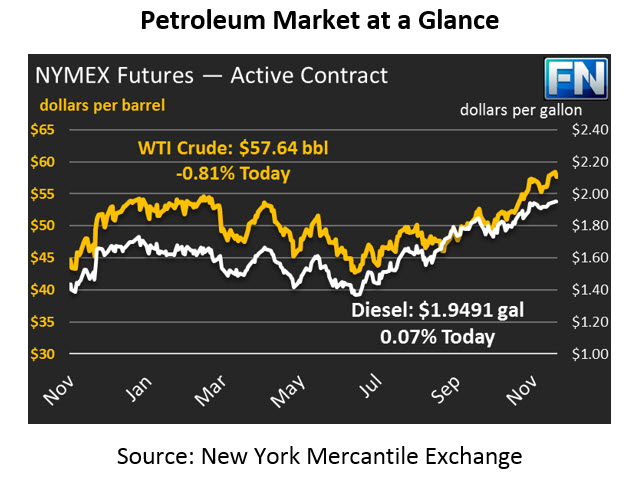

Markets are on the downward trek this morning thanks to news yesterday evening that the Keystone pipeline will resume activities today, once more allowing fuel to flow from Canada to Oklahoma and Illinois. WTI crude prices have responded by falling 25 cents overnight, and continuing declines today. The bearish news comes after WTI crude had already given up 84 cents yesterday. A round of buying as crude dipped below $58 helped bring the price higher temporarily, but the level could not hold and prices have remained below $58 this morning. Crude prices are currently trading at $57.64, a loss of 47 since yesterday’s closing price.

Fuel products traded flat for most of the day yesterday, with diesel shedding 0.3% and gasoline picking up 0.2%. Today, both products remain flat but have flipped sides. Diesel meandered 0.1 cents higher this morning and currently is resting at $1.9491. Gasoline has had a choppier morning, dropping as low as the $1.77 range but currently sitting at $1.7838, a loss of half a cent.

With OPEC’s meeting looming, markets are hesitant to take on new positions. Markets have seen near record high length, meaning far more people are buying than are selling oil contracts. Few are left to add more length to the market, so prices are likely tapped out on the high side for now, and will trade quietly for the week, other than responding to OPEC headlines. It only takes one country voting against an extension to block the measure, so it’s certainly possible that markets will be disappointed by OPEC’s announcement on Thursday.

Much of the contention around the OPEC decision is related to Russia and whether they will choose to back out of the agreement. Russia’s Energy Minister has supported the extension beyond March 2018, but has not given clarity on how long an extension ought to last. Most expect a nine-month extension, though some have hinted that a six-month extension is possible. It’s highly unlikely the group will let the deal lapse in March; the resulting battle for market share would wipe out the gains producers have enjoyed for the past year, perhaps sending prices below $40 once again. No member of the deal benefits from oil prices below $40, so the incentive for all is to join the cuts and accept output limitations.

Yesterday, Morgan Stanley reported that U.S. shale may be less elastic than previously expected. Given rates of hedging and forecasted breakevens, WTI prices between $45-60 will only incentivize limited increases in production, keeping supply in check. This news only further encourages OPEC to extend the deal – if they can keep prices in the $55-60 range, U.S. production will be held at bay while OPEC/Non-OPEC profits will be suitably high to balance budgets. All factors point to a deal extension, but keep in mind that each country still has an individual incentive to cheat once the deal is passed. We’ve made it a long time with outstandingly high compliance from OPEC members, but that could perhaps change in 2018 as producers grow tired of limitations.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.