Today’s Market Trend

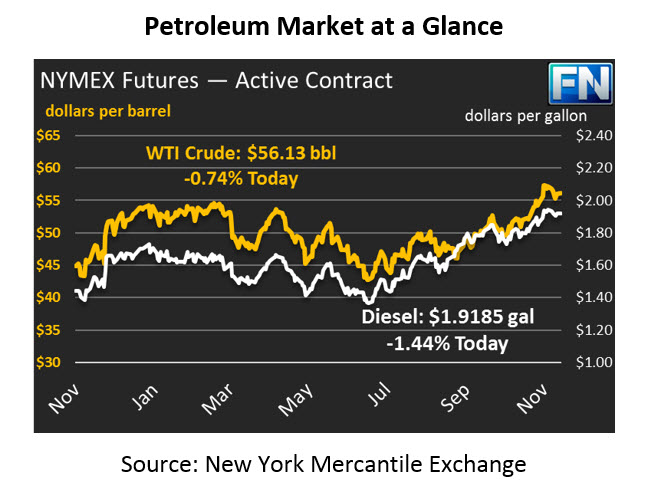

After a huge rally for fuel products on Friday that reversed the week’s losses, oil markets have lost their enthusiasm. Prices are adjusting lower this morning as traders take their profits and exit the market. Although crude prices could not completely reverse their losses for the week, Friday did reduce the losses from $1.76 at Thursday’s close to just $0.35 at Friday’s close. After picking up $1.30 (2.4%) on Friday, crude prices have given up about a third of their gains, falling 42 cents (-0.7%) to trade this morning at X.

Diesel prices also received strong support, picking up over 4 cents (2.1%) on Friday. Gasoline lagged the rest of the market, gaining just 2.6 cents (1.5%) on Friday. Today, both products are posting losses, with diesel prices down 2.8 cents (-1.4%) to trade at $1.9185. Gasoline prices have given up 1.3 cents (-0.8%), trading at $1.7314 this morning.

The Keystone pipeline leak in South Dakota helped push domestic oil prices higher. The Keystone pipeline transports oil from Canada to Oklahoma and Illinois. The pipeline is currently shut down, and TransCanada has not announced when the pipeline will return to operations, though some speculate it will be around Nov 23. A prolonged outage could cause both crude and fuel prices to rise higher, particularly in the Gulf Coast and Chicago markets.

Although prices did rise following the spill, the price impact was not quite so heavily felt in international crude prices. The Brent-WTI spread fell from above $6.50 last week to just $5.80 this week, which could impact export levels reported this week (though any spread above $4 supports exports). WTI crude prices are deliverable to Cushing, OK, one of the destination points of Keystone crude oil. Reduced supply in Cushing reduces the number of contracts available for sale, driving up near-term WTI crude prices while not significantly altering crude supplies in other parts of the world. Canada is still producing crude oil, it’s just not moving to the same places right now. A pipeline outage will cause U.S. prices to rise, but will not have as significant of an impact on international prices.

We’re now just 10 days away from OPEC’s meeting on November 30, where OPEC and Non-OPEC producers will meet to discuss a deal extension. Markets are pricing in a nine-month deal extension through the end of 2018, so anything less than that will likely cause markets to fall back slightly. On the other hand, a longer extension or deeper cuts could cause yet another market rally. Comments from Iran’s Oil Minister indicate that a majority of countries are on board with the cuts, though Russia has left mixed messages on whether it would favor the extension or not. Any major players exiting the deal could also cause markets to shudder and fall lower.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.