Today’s Market Trend

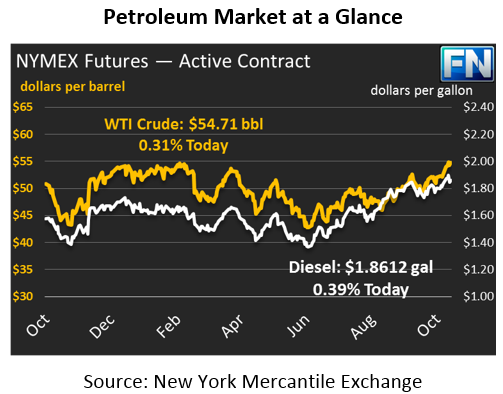

Markets are moving higher this morning after a mixed trading session Thursday. Crude oil made modest gains during yesterday’s sessions, picking up 26 cents from opening to close. Prices continue to move slightly higher this morning, gaining 17 cents to reach its current price of $54.71. Crude is on track to finish the week higher.

Diesel prices did not follow crude’s upward trend yesterday, closing 93 points (.45%) below its opening. Today, diesel prices are up 73 points (.39%) to bring prices to $1.8612. Gasoline prices more closely tracked crude’s gains yesterday, picking up 2.4 cents (+1.4%) to close at $1.7697. Prices have maintained their strength into the morning, gaining another 1.74 cents (.98%) to reach $1.8612.

WTI and Brent futures hit more than 2-year highs yesterday. U.S. inventory draws are providing some strength for crude oil futures as inventories continue to slim vs. the 5-year average. Stronger global economic growth is also believed to be increasing oil demand, driving crude futures higher. The wide spread between WTI and Brent has been narrowing over the past few days, but are still wide enough to encourage exports.

Iraq’s oil minister made an announcement on Thursday that the country will support the OPEC extension, and that $60/bbl would be an acceptable price goal. OPEC will be meeting November 30th to renegotiate the deal and determine whether further extensions will be implemented.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.