Today’s Market Trend

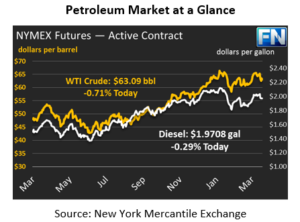

The oil complex is slightly lower across the board this morning. Oil traded mostly flat yesterday remaining in a narrow price range throughout the day and closing just 6 cents lower than its opening price. This morning, crude is trading lower at $63.09, a loss of 45 cents (.71%) since yesterday.

Fuel prices are also pointing down this morning continuing in yesterday’s decline. Like crude, both product prices fell yesterday, though the losses were minimal. Today, diesel is trading at $1.9708, down a mere 57 points from Thursday’s close. Gasoline prices fell slightly more than diesel, losing 87 points to trade at $1.9731 this morning.

The Storms Are Brewing

We are two months away from the Atlantic hurricane season and Colorado State University has released their 2018 outlook. The U.S. continental coastline is forecast to experience “slightly above-average activity” this season, including an increased probability of major hurricanes making landfall.

The team reported a 63% probability for at least one major hurricane to make landfall across the entire continental coastline, up from an average of 52% for the last century. There is also an increased probability for hurricane activity in the East Coast, Peninsular Florida, the Gulf Coast, and the Florida Panhandle. AccuWeather Atlantic hurricane expert Dan Kottlowski also noted that conditions are favorable for early-season formation in the Gulf of Mexico, and areas from Houston to the North Carolina Outer Banks are more likely to receive “direct impacts from tropical storms and hurricanes.”

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.