The Diesel Crisis: Inventories Hit 14-Yr Low

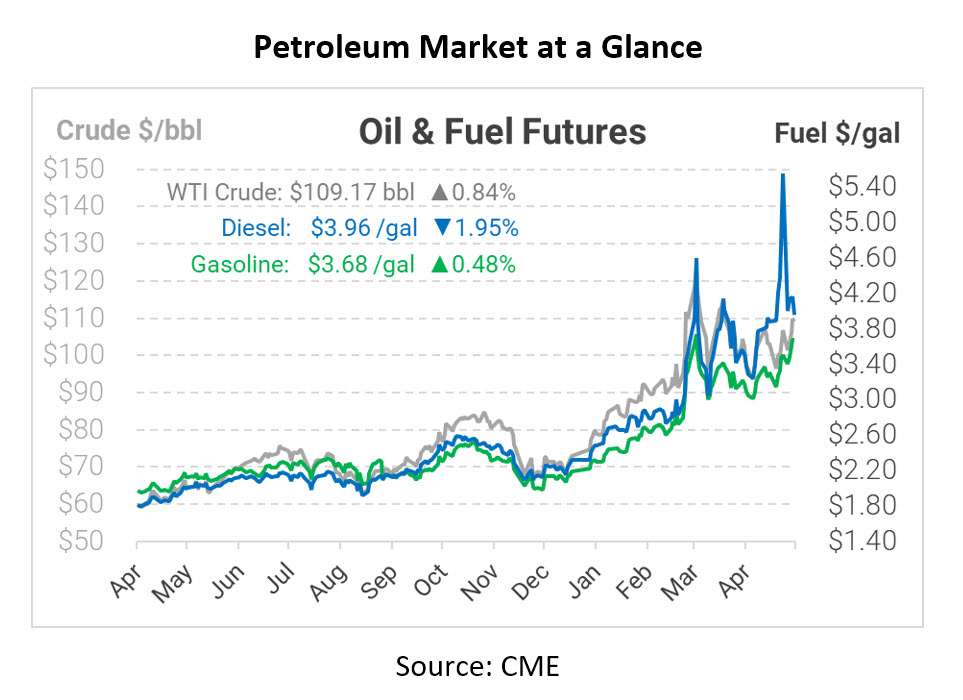

Diesel fuel has become the focal point for oil markets, showing more tightening than other refined fuels or crude oil. This week, diesel stocks hit a 14-year low, trading at their lowest point since 2008 and 2005. According to a Reuters analysis, that could be detrimental for the economy.

A recent Reuters article noted that diesel fuel has fallen “critically low” this year. Since rising 49 million barrels during the COVID crisis, diesel inventories have fallen by 69 million barrels over the last two years. According to the EIA’s report on Wednesday, diesel stocks are down to 104 million barrels, with further declines possible in the coming weeks. According to John Kemp, senior market analyst at Reuters, similar diesel stock lows in the past have not recovered until the economy hits a “soft patch” or recession.

Refiners are producing as much as possible, but efforts to cut off Russian oil flows will be challenging for European refiners. Those countries must import crude from other regions, adding to complexity, delays, and shortages. The US has seen increased demand to export crude and fuels to other countries, including Europe and Latin America, to offset Russian supply losses. With no ways to substantially increase supply, the only option is to decrease demand – which the market will do through high prices and economic downturns.

For corporate fuel buyers, this presents a lose-lose situation – high prices can have a painful effect on operating expenses, while the solution (an economic downturn) is devastating to revenues. As the US economy moves later in the business cycle, the focus is now on managing costs effectively while planning for a weaker business climate ahead. High fuel prices will likely continue until the economy weakens – which could be next week, next month, or next year.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.