The 3 Root Causes of Diesel Supply Challenges

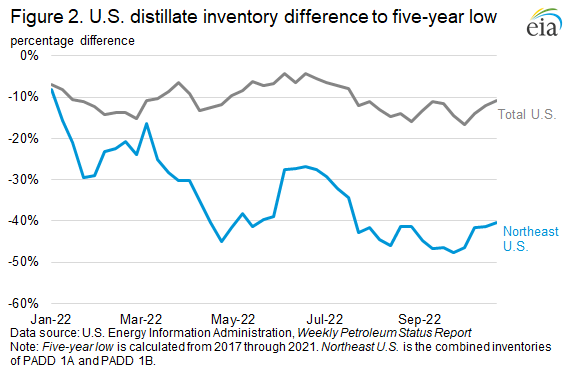

It’s no secret that diesel supplies in the US are tighter than they normally are. Numerous publications have highlighted the challenges faced by markets, especially on the East Coast of the US and in Europe. Last week, the EIA published a chart showing that the Northeast US is 40%-50% below the five-year low, while Europe is also sharply below trend. So, what’s driving the change, and is there a solution?

There are three primary root causes behind the current diesel supply challenges:

- Low Beginning Inventories

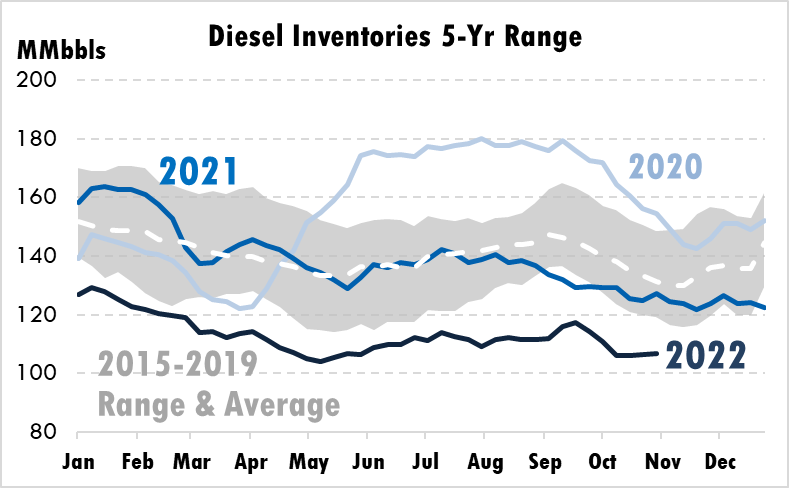

The biggest reason why we’re seeing low inventories this year is, quite simply, because we’ve had low inventories for over a year. For the first half of 2021, diesel inventories were right near the five-year average; in the second half of the year, inventories began slowly falling. Diesel inventories typically follow predictable seasonal patterns, falling during the winter, rising over the summer, then a quick build and fall in the fall ahead of refinery maintenance season.

Opening 2022, markets were 25 million barrels (16%) below the average January level. Those low levels have persisted and steepened over the past few months due to market backwardation, which incentivizes suppliers to pull fuel out of storage rather than putting it in. In September and October, inventories sank to 30 million barrels below the seasonal average. Very high prices over the past few weeks have stemmed the tide of falling inventories, closing the gap back to “just” 25 million barrels.

Ultimately, starting with less inventories leaves less slack in the supply chain. It’s similar to having no emergency savings in your bank account – when surprise bills come in, you have nothing left to pull from. Now, without extra inventories, we have less spare capacity to pull. That doesn’t mean we don’t have enough diesel to meet daily demand, but spikes in demand or supply outages will be particularly challenging.

2. Reduced Refinery Activity

Since 2019, the fuel industry has lost seven refineries, taking 40 million gallons per day of crude processing capacity offline. The reason for these refinery closures vary, from irreparable damage to lost demand during COVID to poor long-term economics. With less refineries available to convert crude to diesel, there’s simply less supply available industry-wide.

Those stats above are specific to crude, which is converted into all kinds of products including gasoline, diesel, jet fuel, etc. Looking at diesel specifically, from 2015-2019, refiners averaged roughly 211 million gallons of diesel produced per day. In 2020, that number fell to 199 million gallons per day (-6%) and fell even lower in 2021 to 195 million gallons per day (-7%). The good news is that refiners are back on track with normal production levels, but it will take time to dig out of the 25-million-barrel inventory hole created last year.

3. Diesel Exports Abroad

The third part of the equation is diesel exports abroad. Diesel exports aren’t as seasonal as production and inventory levels – they tend to move from week to week based on global economics, price arbitrage opportunities, and supply imbalances here and abroad. This year, in July and September, the US set the two highest-ever 4-week average diesel export levels, around 65-66 million gallons per day. Since October, exports have declined sharply to roughly 45 million gallons per day, but those weeks of high exports correspond to diesel inventories sinking farther below the average.

Conclusion

Putting those three factors – low starting inventories, lost refinery production, and diesel exports – it’s no surprise that supplies are currently tight. In fact, we’ve seen some version of tight supply all year. But with winter demand picking up and EU embargoes ahead, there’s more risk of disruptions stretching supply chains thin.

The good news is that key data points are pointing in the right direction. Diesel inventories aren’t rising, but they aren’t falling either. Refiners are finally producing as much diesel as they were before COVID, so hopefully that 25-million-barrel inventory hole won’t widen further. And higher prices in the US have kept more product at home, causing exports to fall.

Overall, supplies are still tight, and we’re in for a winter with plenty of opportunity for volatility. Markets will be closely watching the weather, EU’s embargo, nat gas-to-oil switching for power generation, etc. to see how diesel demand will match up with supply. A lot is unknown, which is why it’s best to be prepared, work with a supplier with a strong portfolio of supply options and keep an eye on the key stats for more information on market direction.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.