Stimulus and Fed Meeting Will Dictate Week’s Trading

Oil markets are seeing light activity this morning following Friday’s news of the first weekly increase in US oil rig counts since March. The US economy is in focus for oil markets today, as two major releases are expected this week.

First, Senate Republicans today will unveil their latest economic stimulus package, which most expect to include another round of $1,200 checks along with support for various industries and groups. As $600/week in additional unemployment benefits expire, Republicans are considering smaller payments on top of typical unemployment. The bill will also likely include tax credits for restaurants and small businesses affected by the pandemic.

Second, the Federal Reserve is meeting to review its interest rate. On March 15, the group cut interest rates to near-zero, creating liquidity for a struggling economy. Since then, the Fed has kept rates low, and a continuation of the existing strategy is expected for the foreseeable future. While the group will not change its approach, their public outlook will be informative. Comments from the Fed Chair, currently Jerome Powell, are known for impacting market direction. Given the current economic state, a glimmer of optimism from Powell could give markets a boost, while a more pessimistic outlook could spell trouble.

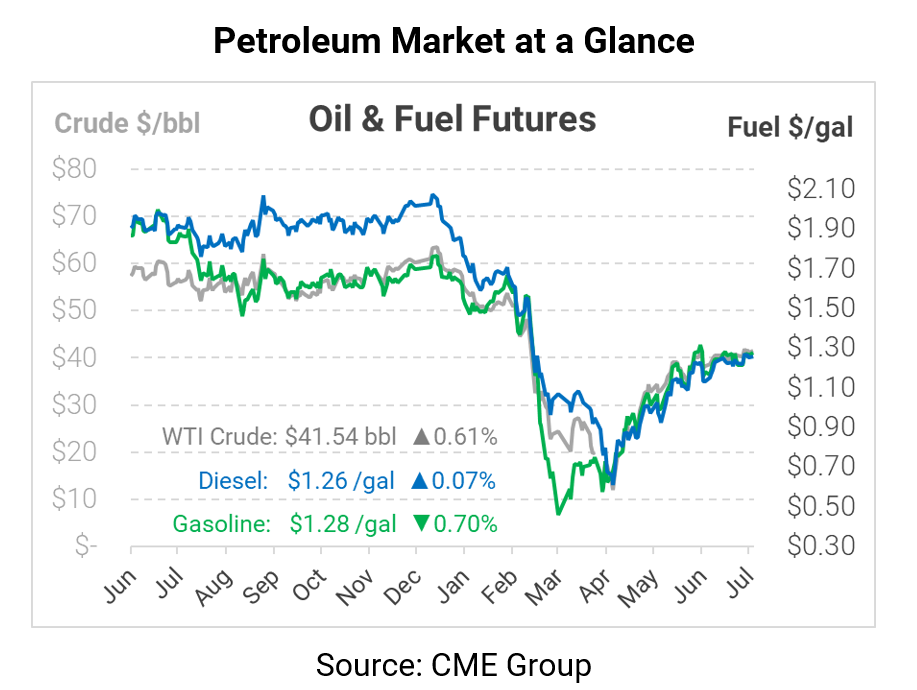

Crude oil is currently seeing moderate gains, though the oil complex is mixed in today’s early morning results. WTI crude is trading at $41.54, up 25 cents from Friday’s closing price. Since May, WTI crude has traded quite close to Brent crude, which has helped support US crude exports. Today the two products are just $2/bbl apart, a result of falling US production and declining maritime transportation costs.

Fuel prices are flat/lower this morning. Diesel prices are trading at $1.2572, barely changed from Friday’s close. Gasoline prices are $1.2758, down 0.9 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.