Refineries Slash Throughput, G20 Commits to Global Stimulus

With America now taking the lead on number of coronavirus cases globally, fuel demand prospects for the coming weeks seems weaker than ever. Amid social distancing efforts, fuel demand is low enough now to evoke a response from refineries. India’s leading refiner has cut throughput by 25%-30%, and East Asian countries are following suit. From Los Angeles, CA to Bayway, NJ, refiners have been slashing utilization rates to accommodate decreased demand, particularly for gasoline and jet fuel. While some are taking refineries offline in response to demand, others are initiating early maintenance cycles to take advantage of downtime.

Global fuel infrastructure operates on a just-in-time basis. Regular pipeline or rail shipments ensure a steady stream of supply, so storage levels are more of a buffer than a long-term solution to severe supply/demand disruptions. With demand cratering, many suppliers are watching inventories to ensure tanks are not overfilled. Once they are, excess product will have on where to go unless new storage is built. If supply chains reach this point, oil prices could fall even farther than they already have.

Internationally, countries are joining together to provide a lift to the global economy. The G20, a group of 19 leading economies as well as the European Union, has pledged to commit over $5 trillion in stimulus efforts, with nearly half of that already passing through the US House of Representatives. The G20 was created during the Global Recession in 2008-09, when leaders committed to similar stimulus efforts. While the announcement shows unity, some have criticized that the G20 is only endorsing current unilateral actions, rather than issuing a coordinated multilateral response from all countries. During the meeting, International Monetary Fund leader Kristalina Georgieva called for G20 members to enable countries to draw up to $1 trillion from IMF resources to boost liquidity.

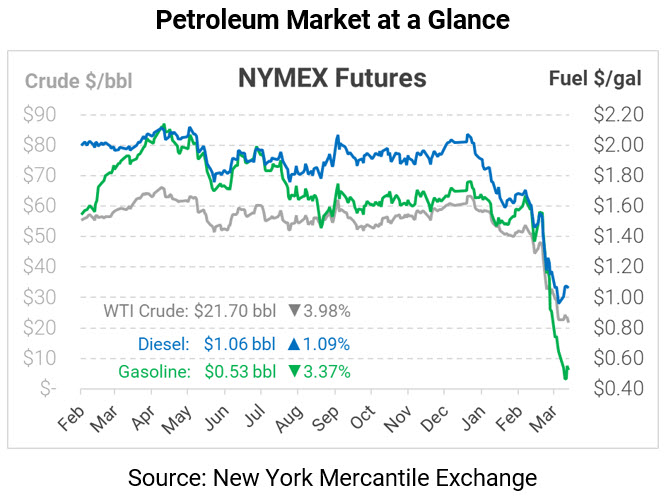

Crude oil prices are currently falling once again. The US is the largest oil consumer in the world, and has now taken the lead in number of COVID-19 cases. Crude is currently trading at $21.70, down 90 cents (4.0%) from Thursday’s close.

Fuel prices are mixed. Diesel prices, which have been less severely affected by the demand slump, is trading at $1.0617, up 1.1 cent (1.1%). Gasoline is trading at $0.5255, down 1.8 cents (-3.4%).

This article is part of COVID-19

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.