Oil Advances on Gulf Production Outages, Jobs Report

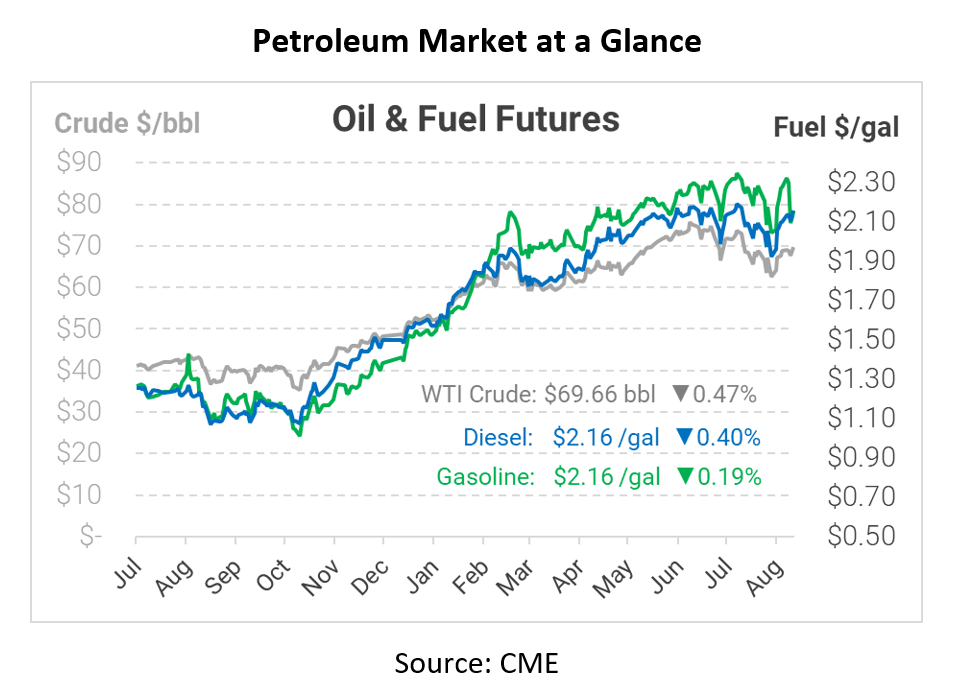

Fuel markets showed gains yesterday, with diesel and gasoline prices advancing by 4 and 5 cents, respectively. Both were supported by crude oil gains driven by the OPEC+ announcement and bullish fundamental data in the US. Total petroleum products demand was 22.8 million barrels per day last week, the highest level in 2021 and nearly a record high. Of course, next week’s report will be severely impacted by Hurricane Ida’s devastation, so it may be a while before we see comparable demand trends again.

Of course, the aftermath of Hurricane Ida remains in focus for oil markets. We expect events like instability in the Middle East or OPEC announcements to impact oil prices, but American production can have just as much of an effect worldwide. Millions of barrels of crude oil production have been taken offline in the Gulf Coast, which will impact global supply and cause prices to rise. To combat the increase, President Biden authorized a release of 1.5 million barrels of oil from the Strategic Petroleum Reserve, though that represents less than one day of the Gulf crude outage.

While all eyes are on the Gulf Coast, the US economy continues chugging along. The US reported 235,000 jobs were created in August, less than half of what the market expected. Part of the slowdown could be caused by reduced economic demand, though many analysts suggest that changes in the labor force may also play a part. The unemployment rate fell to 5.2%, a level considered to roughly represent full employment, and wages rose 4.3% compared to August 2020. Importantly, jobs are a key indicator for the Federal Reserve – continued improvements in labor markets could trigger a tightening of monetary policy, which would cause interest rates to rise and financial markets (including oil) to fall.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.