Demand Concerns Weigh on Markets

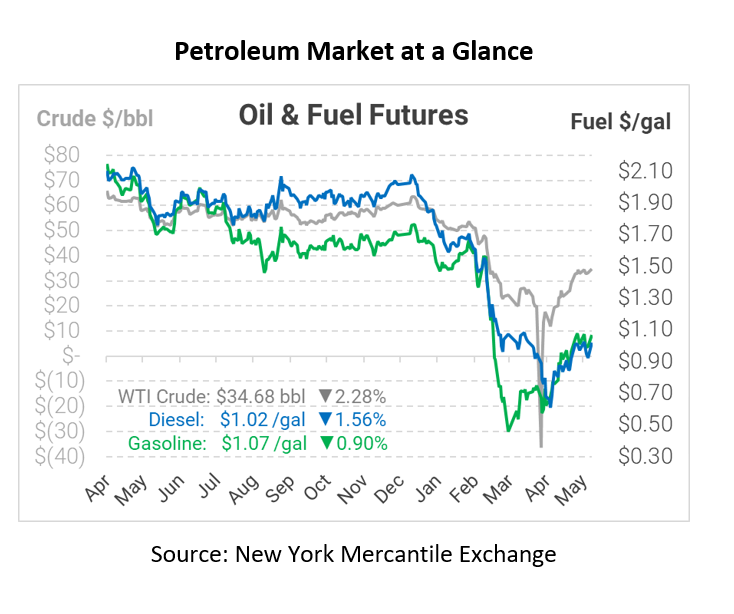

Last week, WTI Crude finished with its fifth straight week of weekly gains. It finished up $1.78 on Friday to close out the week. Crude markets are feeling downward pressure this morning as investors consider demand threats from unrest in the US and deteriorating US-China relations. Also being weighed is the possible continuation of OPEC+ production cuts.

OPEC+ is considering moving up its meeting by a few days to June 4th. At the meeting they will deliberate on whether to extend production cuts from one to three additional months to help balance the crude market. Recently Russia has been vocal about wanting to bring production back online in accordance with the original OPEC+ proposal.

In early trading today, crude prices are up. Crude is currently trading at $34.68, a loss of 81 cents.

Fuel prices are down this morning. Diesel is trading at $1.0204, a loss of 1.6 cents. Gasoline is trading at $1.0688, a loss of 1.0 cent.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.