Supportive EIA Data Can’t Stop Lower Prices

FUELSNews will resume production on Monday, April 22.

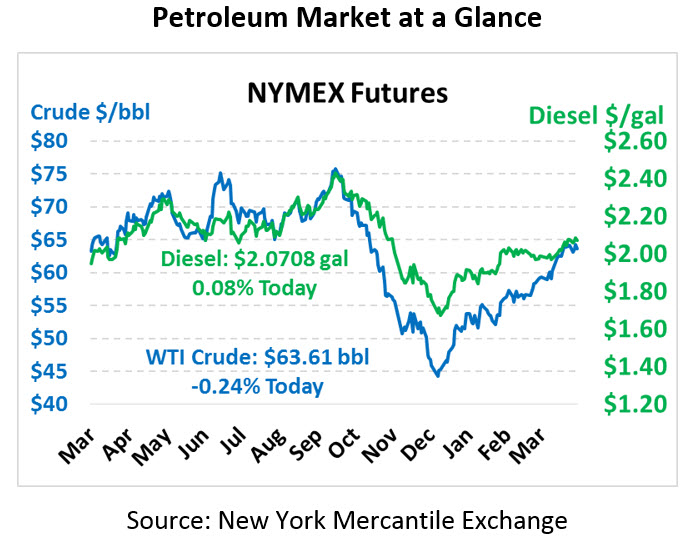

Markets were less than impressed with yesterday’s EIA report despite across-the-board draws for crude, diesel, and gasoline stocks. Crude oil fell back down to the $63/bbl range, with diesel prices following. Yesterday’s losses were less related to the EIA’s report, though, and more tied to equity markets. Today, markets are relatively quiet ahead of a long trading weekend and little news. Crude oil is trading at $63.61, functionally flat with yesterday’s close.

Fuel prices were mixed yesterday, with the gasoline draw spurring higher prices while diesel prices declined. Diesel this morning is trading at $2.0708, flat with yesterday’s price. Gasoline is trading at $2.0582, up 1.6 cents.

The EIA’s report highlighted a moderate draw in crude oil inventories, catching the market off-guard and briefly spurring a rally before prices resumed their downward decline. Crude and diesel both saw smaller draws than anticipated by EIA data, and the API’s data on diesel was completely off-the-mark. The focus of the report was gasoline – every area except the Gulf Coast and Lower Atlantic saw declining gasoline stocks, and demand (though lower than last week) remains strong. Refinery utilization still has yet to roar back into action, mainly weighed down by hefty outages on the West Coast.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.