Strikes, Storms, Sickness, and Saudis – and Soaring Oil

Oil markets are continuing to rally this morning, with no particular catalyst for the rise. In fundamental news, Libya’s production has risen to 290 kbpd – nearly triple the level a few months ago, but well below their 1.2 million barrel per day capacity. A Norweigian oil worker strike is counteracting Libya’s added supply, though, taking 330 kbpd of oil and gas off the market until the strike ends. After being discharged from Walter Reed, President Trump told supporters, “Don’t let [the virus] dominate your lives, get out there, be careful.” Markets view this as a signal that the president’s illness will not change his response to the pandemic or lockdowns.

Hurricane Delta is garnering attention as it barrels upwards into the Gulf of Mexico. The storm is already a Category 2 storm. Regardless of the storm’s final destination, it will almost certainly disrupt Gulf oil production; indeed, oil companies have already begun evacuating crews from oil rigs. Depending on the storm’s particular path, it could also affect Gulf Coast refiners from Houston to Lake Charles, which would cause a temporary drop in refined product output

This week, Goldman Sachs estimated that Saudi Arabia’s 2021-2023 budget estimates rely on oil prices around $50/bbl to balance their finances – a sharp drop from the $83 price required last year. One of the world’s most influential producers, the kingdom’s shift to a lower price target suggests expectations of long-term weakness in oil prices.

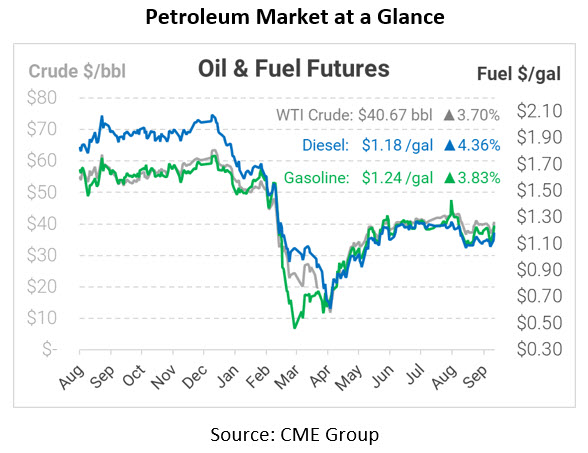

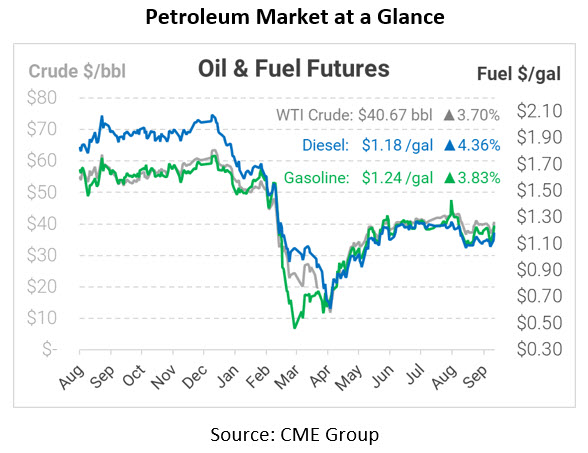

Despite a litany of bullish and bearish factors hitting the market this week, traders seem to be focused on the bullish news for now. Crude oil prices are trading at $40.67 this morning, a gain of $1.45 (3.7%).

Fuel prices are rising even faster than crude, probably a reaction to the approaching storm as traders buy the approach and wait to sell the landfall. Diesel is trading at $1.1827, up 4.9 cents (4.4%) from Monday’s closing price. Gasoline prices are $1.2396, up 4.6 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.