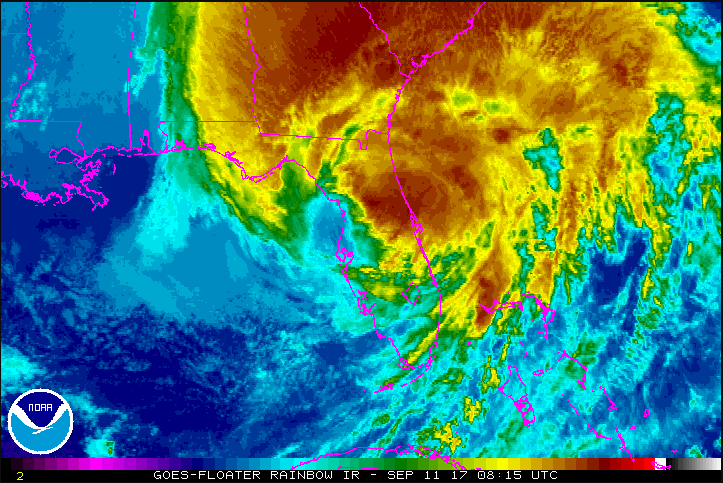

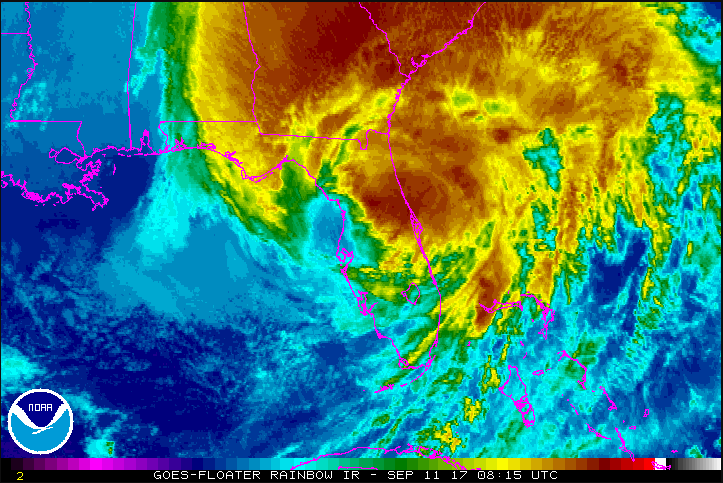

Storm Alert Update – Irma Passes Florida

Irma has blown through Florida quite quickly, with South Florida already beginning to assess the damage from the storm. The storm has progressively lost its force, downgrading to a Category 1 as it tracked passed Tampa and now falling to Tropical Storm status. The storm’s center is expected to travel over the Florida panhandle through South Georgia, then into Alabama.

Although the storm has lost its strength at its center, the storm continues to affect a large area with strong winds. Tropical storm winds continue to affect the entire state of Florida, extending all the way into Georgia. Tornadoes throughout Florida have been reported, and more are possible farther north as the storm continues. Atlanta, GA has announced its first ever tropical storm warning, and all of Georgia is in a state of emergency. Power outages have been reported for over six million households in Florida, more than half the state.

Irma has been weakening very quickly since making landfall in the U.S. Forecasters attribute the weakening to a brief hit on the northern coast of Cuba, which broke up the eye of the storm and interrupted the storm’s circular flow. The disruption can be seen in the storm’s current formation – the eye is virtually indistinguishable, though the storm continues to project heavy wind and rain northward.

Hurricane Jose

Based on the latest forecasts, Hurricane Jose will not directly impact the U.S. The storm is currently forecast to turn back out into the Atlantic, though the storm could possibly begin circulating in place in the Atlantic, depending on track of Irma. We continue to monitor the storm in the low-probability chance the storm does shift course and move closer to the U.S.

Texas Supply:

Markets remain tight. Houston and Corpus Christi are the bright spots for supply, while San Antonio, Dallas, and West Texas remain on Code Red. Long hauls from out-of-state are still necessary in many areas, but supply is slowly beginning to improve. Refining capacity has largely recovered, though roughly 2 MMbpd of refining capacity (less than half of the capacity taken out by Harvey) remains offline.

- San Antonio: Still extremely tight. Some supply has come back online, but allocations have been reduced. Additional re-supply has been delayed from Sept 9 to Sept 12.

- Houston: Moving to code orange on all products. Houston market is generally able to support local demand, but is strong enough to support surrounding cities facing outages

- Dallas FTW: still waiting on Irving terminal to reopen as an alternative sourcing point – expect resupply today or tomorrow. Motiva is expecting resupply on the 14th.

- Corpus Christi: Supply remains in good shape, and this market has been a sourcing point for long-hauls. Carrier capacity is the main constraint on re-supply efforts.

- West Texas/El Paso: No rack supply available. Resupply not expected for over a week. Long hauling from markets further east.

- Waco: No rack supply available. Resupply expected towards the end of this week.

Southeast Supply:

Supply remains tight through the Southeast. Batches of fuel on Colonial are still coming out of order, making it difficult to set estimates for when supply will normalize. Demand remains extremely high, pushing carrier capacity to its limits. Even in some areas with sufficient supply, lack of available local carriers has required long-hauls from other markets.

Diesel remains in better shape than gasoline, which is tight in Georgia and the Carolinas. Diesel spot availability is also tight. It remains a possibility that some carriers will need to temporarily take trucks off the road due to strong winds, but the effects of this would be temporary.

Florida Supply:

The state’s fueling infrastructure remains on virtual shutdown. Terminals will begin to assess damage when conditions are safe and will report on expected returns to operations. Because not all deliveries could be made before Irma hit, suppliers are dealing with backlogs that will be addressed when operations resume. For this reason, new orders in some markets may not be delivered for four days or more.

- Everglades/Miami: Initial feedback from terminals has been positive, and operations could re-start as soon as tonight. Terminal personnel are still assessing racks for damage.

- Tampa: Should begin hearing reports from Tampa terminals as early as this evening, as Irma’s impact on Tampa was not as bad as expected. Since Orlando is fed by a pipeline from Tampa, its market is tied to Tampa’s.

- Jacksonville: Still getting high winds currently, could be tonight or tomorrow before we hear from Jacksonville terminals.

Market Summary

Mansfield continues to work around the clock to help our customers fuel during the storm. If you have any questions or need to secure supply in the Gulf, Southeast, or in Florida, please reach out to your sales rep or customer relationship manager for more information about ordering product. Please place orders 48-72 hours in advance whenever possible, to allow time to secure supply and freight during the shortage.

Code Red (Areas with significantly reduced or unavailable supply)

- Austin, TX

- Beaumont, TX

- Buda, TX

- Dallas/Ft Worth, TX

- El Paso, TX

- Houston, TX

- Port Arthur, TX

- San Antonio, TX

- Waco, TX

- Southeast States (Mississippi through Maryland)

- Florida

Code Orange (Areas with limited supply availability)

- Corpus Christi, TX

- Edinburgh, TX

- Harlingen, TX

- Odessa, TX

- Lake Charles, LA

- Baton Rouge, LA

This article is part of Alerts

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.