Saudis Cutoff US Exports & Majors Cut Output

Markets are receiving a boost following Trump’s Executive Order over the weekend. Trump signed the order to support economic recovery while Congress argues over the specific details of stimulus legislation. Experts are debating the efficacy of the order, since some of its measures may only be partially effective in supporting the economy. Still, markets are happy to see some action, and the executive action may provide guidance to Congress that helps break the gridlock.

As demand prospects improve, supplies are also being cut. Saudi Arabia has once again limited oil exports to the US, attempting to lower inventories in the world’s most transparent energy market. This comes after exports from Saudi Arabia peaked at six-year highs amidst global demand issues. While Saudi Arabia cannot unilaterally control US inventories – global oil flows will simply shift around – the short-term implication could be lower inventories in the next few weeks.

OPEC is not the only one slashing output. Oil majors have cut their production by 1 MMbpd, according to Reuters. Oil majors took a huge financial hit from the oil bust, writing off billions of dollars in assets and cutting back output to alleviate expenses. Combined with last week’s rig count hitting a new record low, it’s clear that oil production will continue to feel the pain of low prices even as the economy slowly recovers. While short-term price pressures remain, this confluence of bullish factors may give prices a lift over the medium-to-long term.

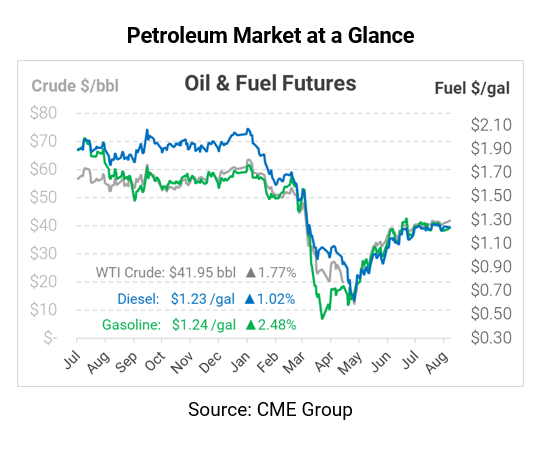

Crude oil prices are moving higher once again after dropping on Friday. WTI crude is trading at $41.95 this morning, up 73 cents (1.8%).

Fuel prices are also receiving a lift, with gasoline leading the way. Gasoline is trading at $1.2375, up 3.0 cents (2.5%) from Friday’s closing price. Notably, gasoline is now trading above diesel once again, the first time since the August contract expired two weeks ago. Diesel is trading at $1.2324, up 1.3 cents (1.0%).

This article is part of Daily Market News & Insights

Tagged: gasoline prices, Oil Majors, Saudi Arabia

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.