Russia Pulls Back Troops; Biden Warns of Market Impact

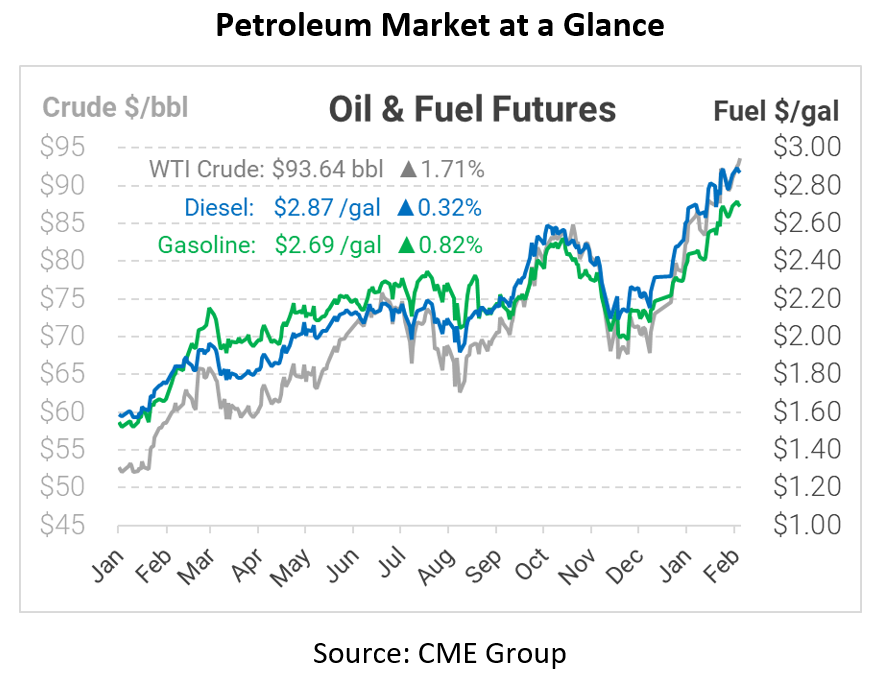

Despite reports of Russian troops being pulled back from the Ukrainian border, oil prices continue setting fresh 7-year highs this week, with more gains this morning. Yesterday WTI crude hit a high of $95.17, with prices also climbing this morning. Diesel opened the day at $2.8705 and gasoline at $2.6762.

In a shocking move by Russia amid extremely high tensions in the east, Russia withdrew a reported 150,000 troops from the Russia-Ukraine border yesterday. The Kremlin reported the size of the withdraw, though many do not believe the country amid the deceit they have dealt out over the past few weeks. While one side reports that the Russian pullback of troops could be the beginning of a diplomatic resolution to the threat of invasion, NATO leaders do not hold the same opinion. NATO Secretary-General Jens Stoltenberg today said that Russia has “increased the number of troops – and more troops are on the way.” Conflicting intel continues to be the story of this situation, but the United States and allies remain adamant that this situation is far from over.

President Biden spoke on Tuesday about how this situation could continue to impact oil prices. “I will not pretend this will be painless, there could be impact on our energy prices. So, we are taking active steps to elevate the pressure on our own energy markets to offset raising prices,” Biden said during a briefing at the White House. Following his remarks, the president noted that the U.S. would coordinate with all major energy producers and their respective consumers to have measures in place to counter rising prices. In addition to the consumer and producer talks, Biden has asked Congress for aid in mitigating prices.

For context, Russia was the third-biggest supplier of foreign petroleum for the United States in 2020 (EIA). They are responsible for 7% of all imported oil and exported $13 billion in mineral fuels to the States in 2019. Following an invasion, sanctions on Russia could begin a trade war, cutting off America’s access to this oil and causing fuel prices to rise. A significant impact on fuel markets remains a concern if Russia launches an invasion. Hopefully, this week’s withdraw signals less threat of escalation – but there’s still plenty of uncertainty ahead.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.