Rig Count 67% Down from March Peak

On Wednesday, WTI Crude closed higher based on a sizeable crude draw reported by the EIA and a weak dollar. WTI Crude closed at $42.19/bbl, up 1.2% – the highest close since early March.

According to the US Land Rig Count Tracker report, rig counts decreased by five rigs to 263 active rigs. The number of active rigs is down 67% from its March peak. Goldman Sachs expects rig counts to remain near these lows for the rest of 2020. Most rig activity is seen in the Permian basin, but activity in the region has declined precipitously since the pandemic began.

In other news yesterday, a US appeals court has said the Dakota Access Pipeline does not need to be shut down as had been ordered by a lower court. In July, the lower court said the Army Corp. of Engineers broke the law when they granted an easement to construct a pipeline under a lake that provided drinking water for the Standing Rock Sioux tribe. The pipeline will be allowed to flow oil while the parties return to the lower court for further proceedings.

The EIA reported a large decrease for crude of 7.4 MMbbls, versus an expected decrease of 3.3 MMbbls. At Cushing, the EIA reported that stocks rose by 0.5 MMbbls. US crude oil inventories are about 16% above the five-year average for this time of year. Distillates reported a build and continue to trend roughly 27% above the five-year average. Gasoline reported a surprise build in stocks and is about 8% above the five-year average.

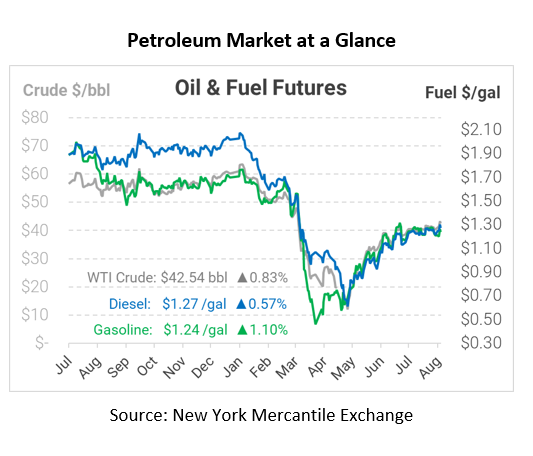

Crude prices are up this morning. WTI Crude is trading at $42.54, a gain of 35 cents.

Fuel is up in early trading this morning. Diesel is trading at $1.2703, a gain of 0.7 cents. Gasoline is trading at $1.2362, a gain of 1.3 cents.

This article is part of Daily Market News & Insights

Tagged: Dakota Access Pipeline, pandemic, rigs

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.