As Prices Rise, OPEC Considers New Target for Production Cuts

Markets continued Friday’s momentum yesterday as Presidents Day kept trading volumes low. Markets trended slightly upward, though clear price direction was hard to determine during the market holiday. On Friday prices closed at $61.68 – today they are 31 cents (0.5%) higher, trading at $61.99.

Refined fuels are also trading at their highest levels since early February. Diesel fuels are up 1.8 cents (1.0%), trading at $1.9285. Gasoline has risen a bit more slowly, up 1.3 cents (0.8%) to $1.7643.

Dollar Fluctuations Create Downward Pressure

The dollar has been putting pressure on oil prices, with small gains over the past few trading sessions. Markets are pricing in a 100% chance of an interest rate hike in March, despite rising prices reducing retail sales. Higher interest rates lead international investors to invest in U.S. bonds, requiring that they buy U.S. dollars first (ie, demand for dollars rises). As the U.S. dollar rises, crude oil prices (and all commodity prices) shrink for a variety of reason, the main one being that it’s more expensive to buy the dollars needed to invest in crude markets. Since the interest rate hike is already being priced into today’s dollar, the hike is also being priced into crude markets, creating downward pressure on prices.

OPEC Considers New Target for Production Cuts

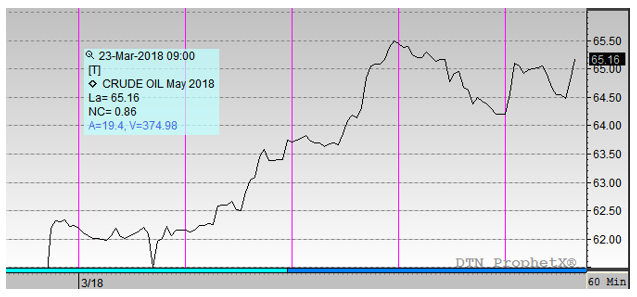

Some OPEC members are beginning to hint that 5-year inventory ranges may not have been the best target to use for predicting prices For instance, consider the two charts below – a rolling 5-year range, and a historical range. The first chart shows that inventories are quite close to their 2012-2017 average, and well below the high. This is how OPEC has evaluated five-year averages in the past.

The example below, how FUELSNews typically displays inventories, reveals that we have yet to return to the narrow 2012-15 range, despite falling well below 2016-17 levels.

Why did OPEC use rolling averages? They may have chosen it originally because it would be an easier target. When production cuts were first adopted in November 2016, markets were highly skeptical that OPEC would make progress. With a rolling average, all OPEC had to do was wait long enough for the average to rise, then point out their success. Now that the organization has been more successful with their cuts, they are looking at other methods that would show true success in balancing markets.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.