Prices Reach Two-Month High

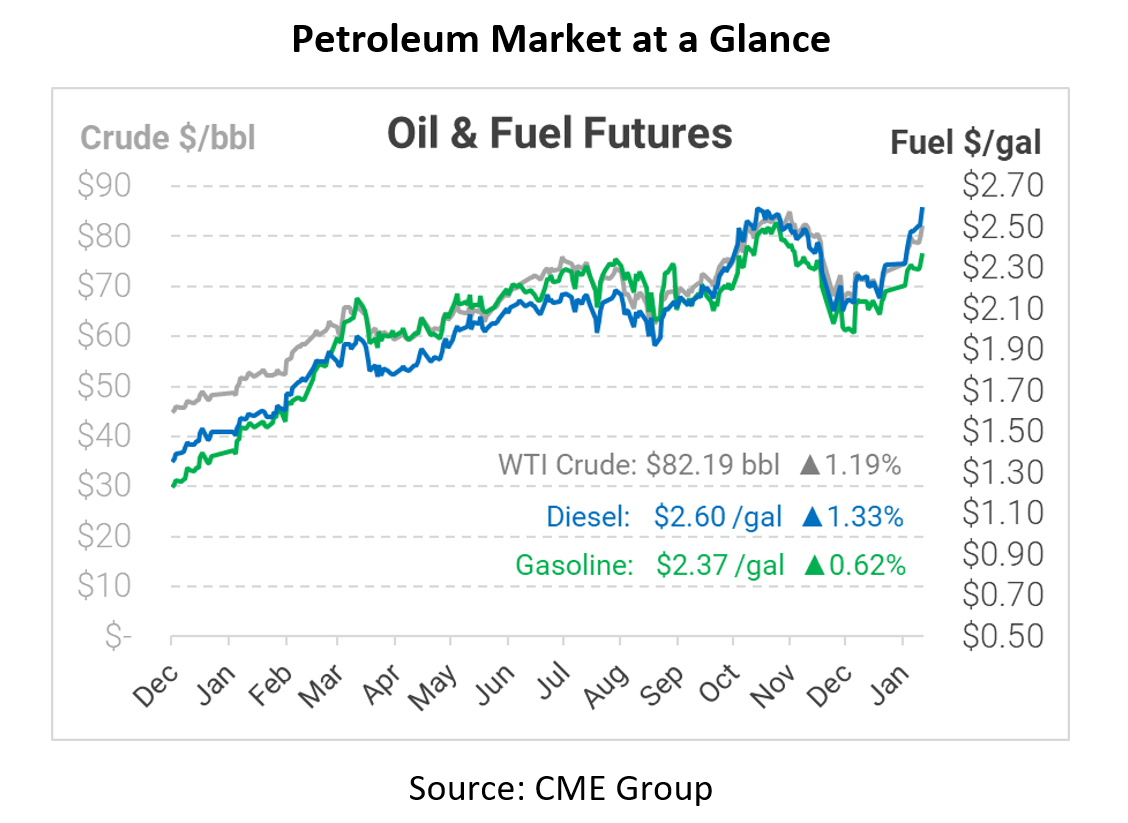

This morning oil prices are reaching a two-month high as new concerns of how Omicron could severely impact demand are flooding the market. WTI crude oil opened the day at $81.38, diesel at $2.5638, and gasoline $2.3477.

Today marks the highest prices that oil have risen since November 11 and the first time that oil has broken $81 in two months. After recent trends of prices climbing, forecasters have changed some of their predictions about what is to come. The EIA projects gasoline to cost on average around $3.06 per gallon in 2022. Click Here to read more about what to expect to pay at the pump in 2022. For the most part oil prices kept sliding on fears about the new Omicron variant and what it would bring, but that has taken a drastic change.

On Tuesday oil closed 24% above the recent lows that the market was experiencing, and that is cause for concern. While the world is not ready for a time when oil could reach $100, some do predict that we could be reaching a time where $90 is not a far-fetched number for prices to hit. Many banks such as J.P. Morgan are concerned with the trend we are seeing now, as inventory levels continue falling and minimal new investments to the sector are being pursued.

The most frustrating part for consumers about the recent spikes come from the fact that world economies are still getting almost zero help from OPEC+. They continue to hold back more than three million barrels per day (bpd) in output. New Iranian sanctions are preventing some of these exports from happening, but OPEC+ has kept with their current output levels for some time now. With the United States releasing new information that they are expecting U.S. demand to rising to 840,000 bpd in 2022 compared to a previous forecast of 700,000 bpd, it seems that once again we will be waiting on OPEC+ to act, but that is just once piece of the puzzle that is oil prices.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.