Prices Keep Sinking, Merrill Lynch Predicts 2019 Reversal

Merry Christmas! FUELSNews will resume publications on Wednesday, December 26. Have a Safe and Happy Holidays!

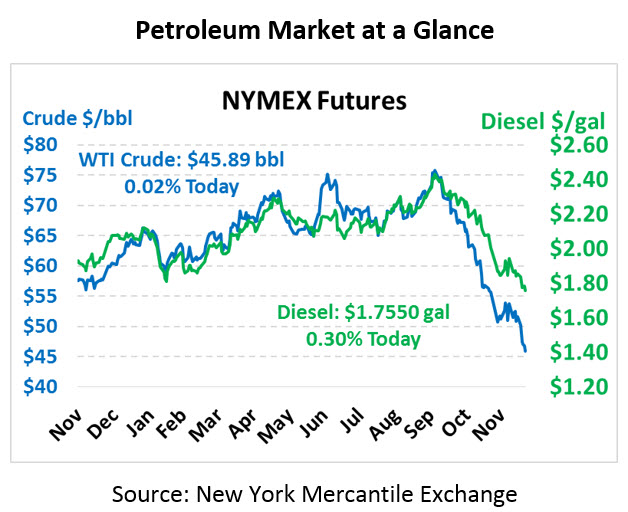

WTI crude prices are back down to trading just above the $45 threshold as markets head into the holiday weekend after another round of bearish stock market performance. The Dow Jones Industrial Average has fallen to its lowest point since October 2017, losing 15% since September’s peak. Crude prices, of course, have fallen by far more that 15%. Crude is currently trading at $45.89, flat from yesterday’s close but off 35% from its peak in October.

Fuel prices are also flat to weaker this morning, with gasoline hitting new lows. Diesel prices are trading at $1.755, gaining a meager 0.5 cents from Thursday’s close. Gasoline prices are $1.3196, a loss of 0.3 cents.

Chinese companies are planning to opt out of US crude oil in 2019 despite oil remaining outside the trade war. Although the two countries reached a 3-month trade truce, Chinese companies have cut imports due to political uncertainty and abundant supplies from Russia and Iran. Without Chinese purchases, expect downward pressure on WTI oil prices, given reduced demand for that specific product.

With prices plummeting, consumers are rushing to lock in fuel prices for 2019. Markets generally expect prices to rise. As Merrill Lynch wrote this morning, “The production cuts will start in January and Saudi Arabia is already reducing volumes this month, so we should see a recovery in about a month or two.” Still, in the short-term it’s hard to expect a significant rally given booming production in the US, a flummoxed stock market, and a looming government shutdown tonight.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.