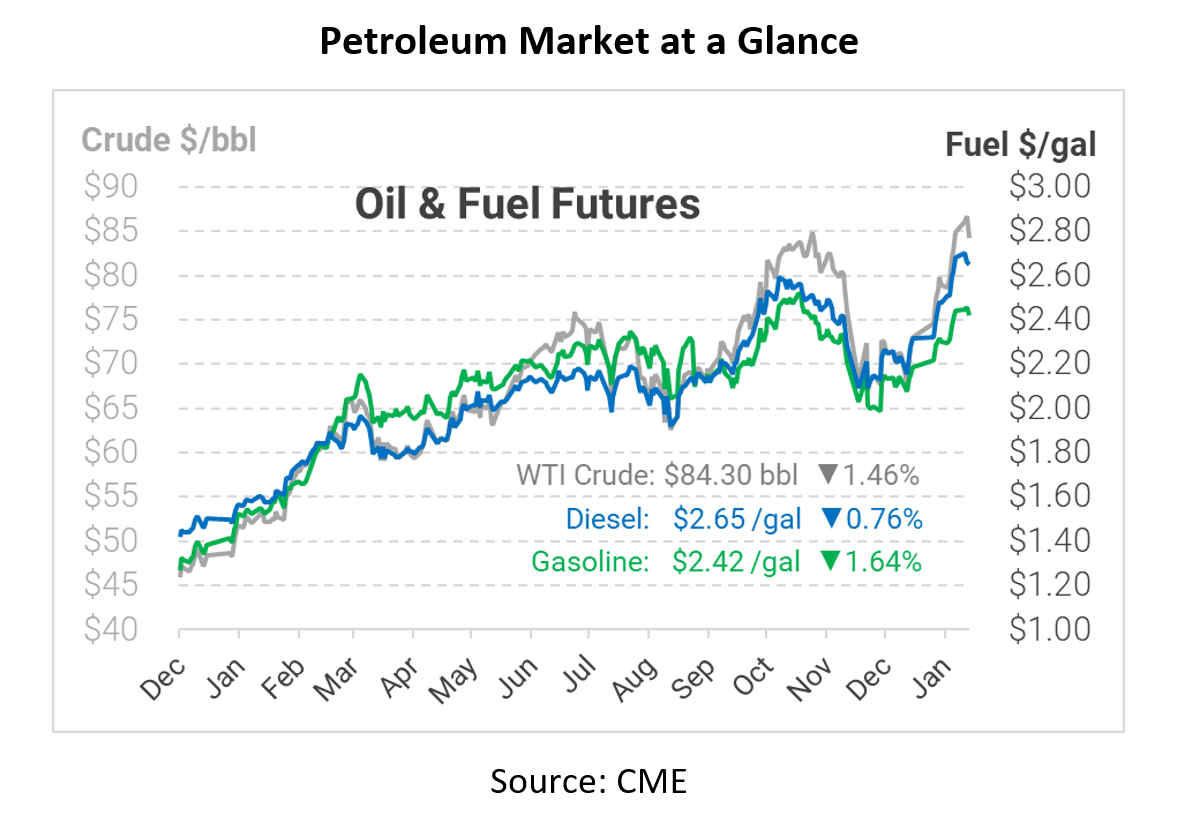

Prices Fall, but More Fuel Gains to Come

Oil prices are falling back this morning after climbing as high as $67/bbl this week. Even after retreating, though, prices remain above the 7-year high. Morgan Stanley recently noted a “triple deficit” that will keep prices moving higher in 2022: low inventories, low spare capacity, and low investment in new production. These factors will propel prices above $100 in the second half of 2022, according to the investment bank.

Part of the slow trading may be due to the approaching winter storm for the East Coast, the second storm in a week. With 60 million residents under ice and snow advisories, travel will slow down, curbing gasoline and jet fuel demand. Of course, there are some factors that make for it, including panic buying before/after the storm and the deployment of recovery teams like utility trucks and snow plows. Cold weather will also bring an uptick in heating oil demand, putting upward pressure on diesel prices.

Although demand (especially for gasoline) may take a hit this week from the storm, the EIA’s report yesterday shows that overall trends are strong. The US consumed 21.2 million barrels per day of petroleum products last week, surpassing pre-pandemic levels. Back in December, weekly readings moved over 23 MMbpd – an all-time high. Considering that demand is setting new records in the US, it’s no surprise that prices have moved to fresh seven-year highs.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.