Pipeline Delays Boost 2019 Forecasts

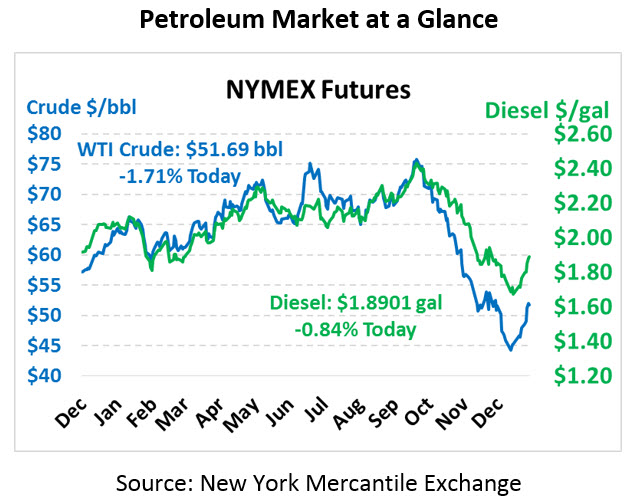

Determined to prove wrong anyone calling for lower prices, crude markets reversed their morning losses yesterday and eked out a small gain, bringing the streak of up days to nine – the longest up-streak since 2010. This morning is once again beginning lower, though it’s anyone’s guess how prices will end this afternoon. WTI Crude is currently trading at $51.69, down 90 cents (-1.7%) from yesterday’s close.

Fuel prices are also printing in the red this morning after posting meager gains yesterday. After closing above $1.90 for the first time since early December, diesel prices are currently $1.8901, down 1.6 cents (-0.8%) from yesterday’s close. Gasoline prices are down to $1.4136, a loss of 1.7 cents (-1.2%).

Last night the Federal Reserve chairman Jerome Powell shared that the Fed would not rush to hike rates in 2019, instead waiting to see how the economy evolves. Federal interest rate hikes cause the US Dollar to gain strength, in turn pushing commodity prices lower. Fewer rate hikes in 2019 would allow oil prices to rise higher without facing currency headwinds.

In more long-term news, regulatory delays have slowed down the development of EPIC’s pipeline in the Permian. Today, oil producers in the Permian basin (the most prolific production area in the US) have had to cut back because they do not have enough pipelines to get their product to market. A number of pipelines are in development to alleviate the bottleneck, but EPIC was expected to be the first on the scene. The Q3 rollout may end up a bust. Because delays trap more product in the Permian, it will result in less production and therefore higher price forecasts for the latter half of 2019 and into 2020.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.