OPEC Tapering Cuts Spurs Fresh Crude Highs

Oil prices are moving to new highs this morning following OPEC+’s decision yesterday to taper its production cuts slightly. Since August, the group has been cutting 7.7 MMbpd. When their agreement was first struck early in 2020, the plan was to reduce cuts to just 5.7 MMbpd in January 2021. Markets had suspected that OPEC could change its approach given recent lockdowns, and yesterday’s announcement that cuts would only be reduced to 7.2 MMbpd confirmed the group is taking a cautious approach to winding down its supply cuts.

Looking ahead, the group may hold cuts to the new 7.2 MMbpd level, or they could continue tapering over time. OPEC+ plans to meet monthly to discuss needed changes to its production strategy. For consumers, this tapered approach can be viewed positively. Extending current cuts through 2021 would have created supply shortages that might have triggered price spikes. Conversely, a sudden surge in supply would overwhelm markets, which is short-term beneficial but long-term hurts oil investments. This more predictable approach allows oil companies to invest for future production while still keeping markets supplied in the interim.

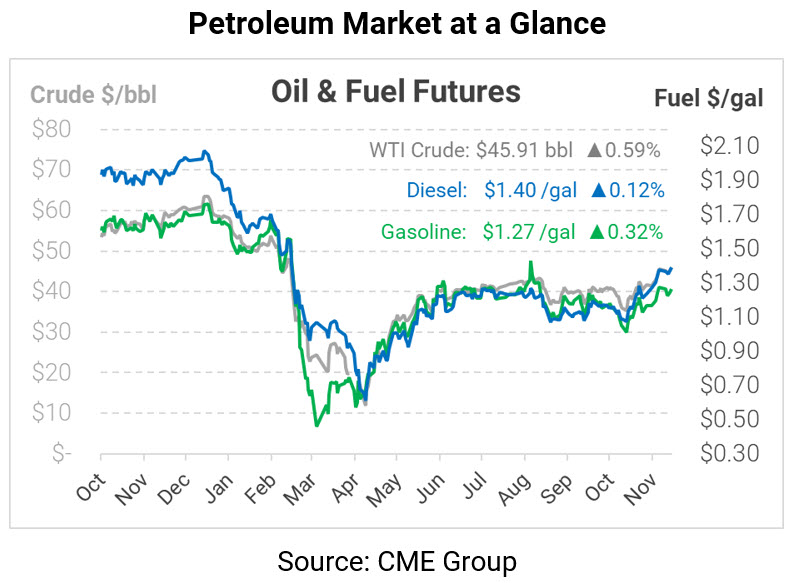

Crude oil prices climbed over $46.60 this morning, the highest level in months, though continued trading has moderated those gains. WTI crude is currently trading at $$45.91, up 27 cents from Thursday’s close.

Fuel prices are also trading a bit higher, though off from their early morning highs. Diesel prices are currently $1.3950, up 0.2 cents from Thursday and at the highest level since March. Gasoline prices are $1.2658, up 0.4 cents.

This article is part of Daily Market News & Insights

Tagged: opec

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.