OPEC Maintains Supply Increases Despite India Slowdown

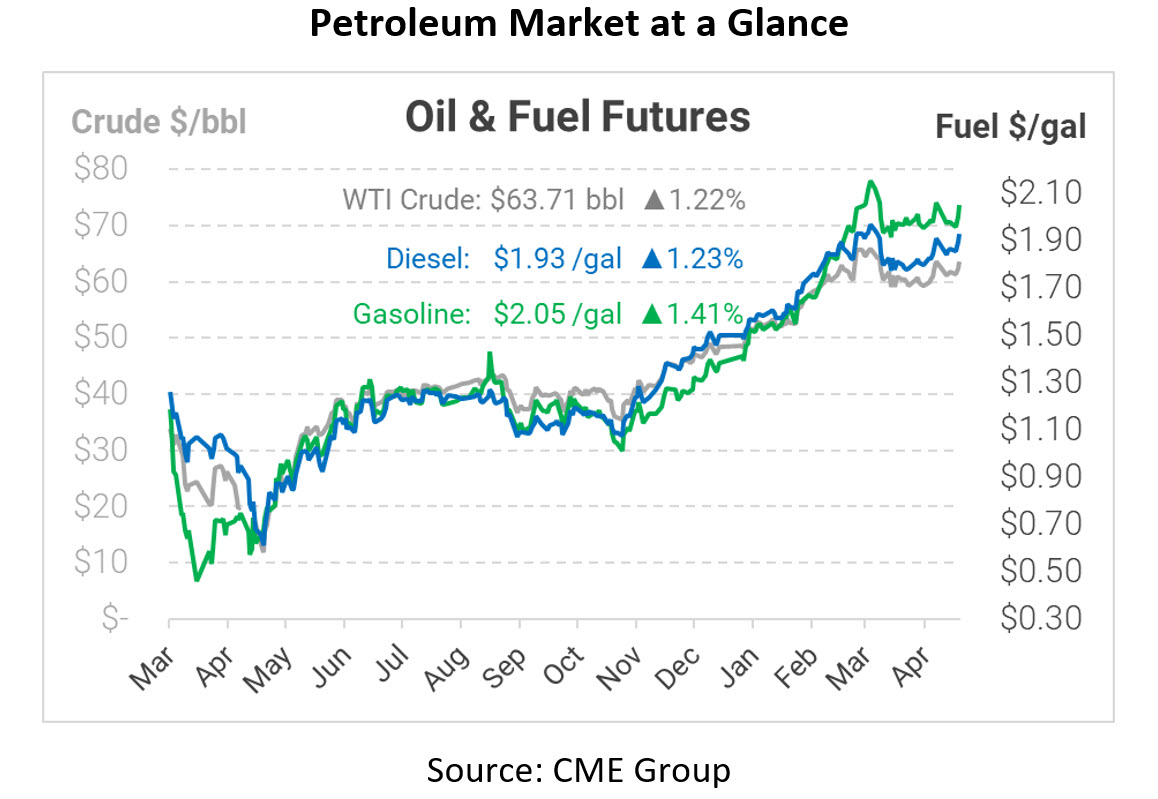

Despite a mixed API report, crude oil markets gained nearly a dollar per barrel yesterday, and the gains are continuing this morning. The CDC loosened guidelines on mask-wearing in the US, saying that mask-wearing outdoors was unnecessary except in crowds and that fully vaccinated individuals can assemble indoors without masks. The measure adds confidence that the worst of the pandemic is in the rearview, which gave markets a lift.

Yesterday, OPEC+ announced they would proceed with slowly increasing their output despite slowing Indian and Brazilian oil demand. The group pointed out that global oil demand is still on track to grow by 6 MMbpd in 2021, so there’s plenty of room to increase output. Over the next three months, OPEC+ will phase in 2 MMbpd of oil supply, roughly a quarter of the supply production being idled. The technical committee also pointed out that global inventories will fall at a rapid clip of 1.2 MMbpd – a 50% increase compared to last month’s projected 800 kbpd draw.

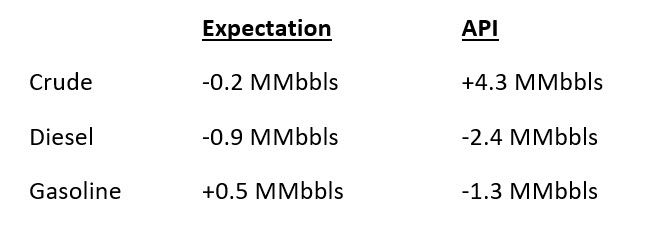

The API’s report showed a large build for crude oil, but markets seemed more interested in the product draws. Diesel inventories fell 2.4 million barrels, while gasoline sank by 1.3 million barrels. Markets will be watching closely today to see how the EIA’s data compares.

This article is part of Daily Market News & Insights

Tagged: COVID, Inventories, opec, vaccines

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.