OPEC Extends Deep Cuts through March

Oil prices continued their rally through this morning, buoyed by OPEC+’s commitment yesterday to maintain current production cuts. The committee agreed to extend cuts into February and March. OPEC+ will meet in March to review plans for the rest of the year. Yesterday’s meeting shows the group remains committed to keeping markets undersupplied this year, forcing inventories to return to normal.

The EIA’s report yesterday was less bullish than the API’s across the board draw. Last week, crude stocks fell by a million barrels, right in line with seasonal market expectations. Diesel remained unchanged, falling just 9,000 barrels across the country. Gasoline’s hefty build of 4.5 million barrels could be construed as a sign for alarm, yet markets shook it off – focusing more on the fact that gasoline stocks remain below the seasonal five-year average.

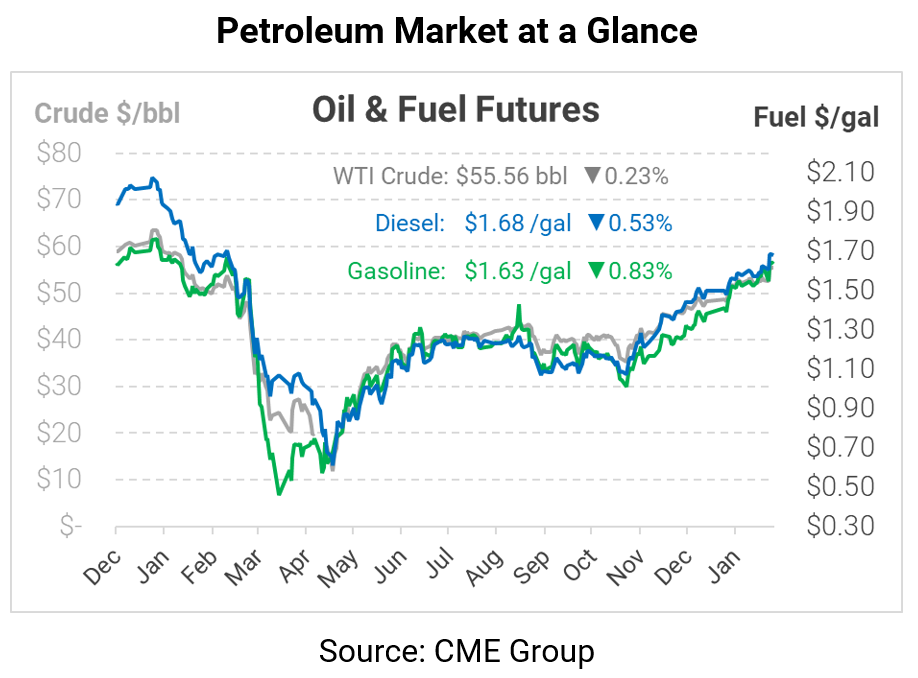

Although this morning saw more price gains, sentiments have shifted as COVID cases continue spreading and countries fight the pandemic. WTI crude is currently trading at $55.56, down 13 cents.

Fuel prices are also moving lower after hitting multi-month highs yesterday. Gasoline is trading at $1.6349, down 1.4 cents from Wednesday’s closing price. Diesel prices are $1.6815, down 0.9 cents.

This article is part of Daily Market News & Insights

Tagged: Inventories, opec

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.