OPEC+ Aims for Higher Oil Prices – How High Is Enough?

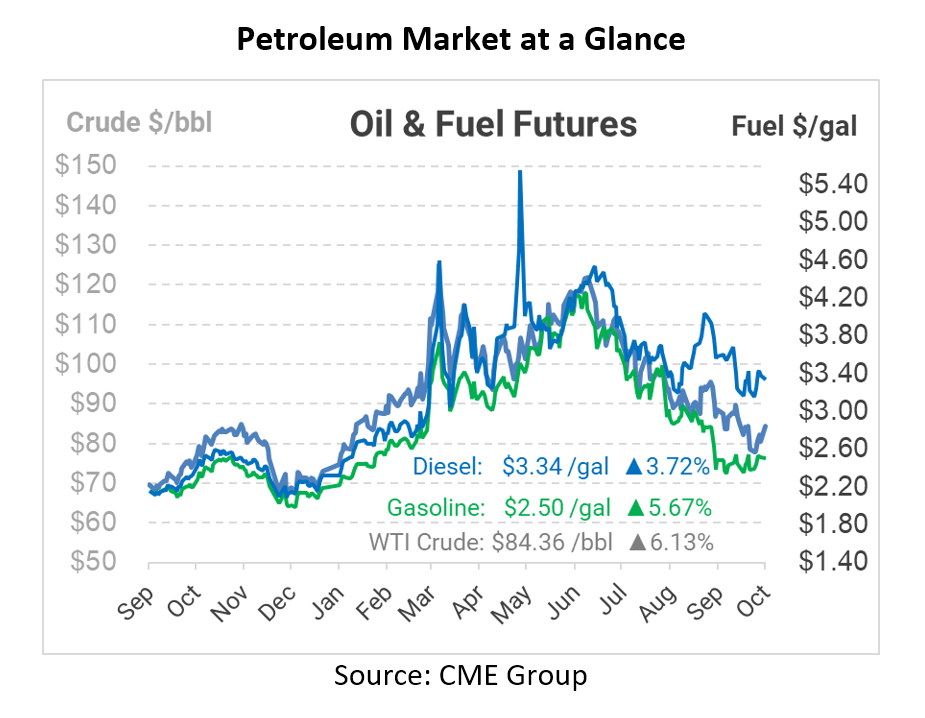

Oil markets are rebounding this morning after a sell-off last week, with crude oil back above $80/bbl and fuel prices gaining 10 cents per gallon. OPEC+ is reportedly weighing potential oil production cuts as high as 1 million barrels per day (MMbpd), the largest cut since the group collectively slashed supply by 9.7 MMbpd in 2020. Several comments from OPEC officials hint that the cartel grew comfortable with crude oil above $100/bbl, and wants to see that level sustained in the future.

Last month, OPEC+ agreed to a symbolic cut of 100 kbpd to show their willingness to keep a floor under the market. The cut was symbolic because OPEC+ is not producing as much as their quotas allow; in August, the group produced 38.7 MMbpd, compared to quotas of 42.10 MMbpd. By that measure, lowering their quotas by 1 MMbpd won’t have any impact on actual supply entering the market. The biggest underruns are from Russia (-1.2 MMbpd), Nigeria (-0.85 MMbpd), and Kazakhstan (-0.5 MMbpd). Depending on how the reduced quotas are shared among members, Bloomberg estimates that even a larger 1.5 MMbpd cut would only result in physical cuts of 600 kbpd – largely from Saudi Arabia, Iraq, and Kuwait.

While OPEC is providing symbolic support for prices, European refiners may deliver real challenges for fuel markets. France continues to suffer 750 kbpd fuel outages due to labor strikes. Outside of France’s acute challenges, analysts project that roughly 1.5 MMbpd of refining capacity will be offline this month due to planned and unplanned maintenance. Repairs delayed in 2020 and 2021 due to COVID restrictions are now coming due, adding time and costs during a period when prices are at record highs.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.