Oil Weak Heading into Holiday Weekend

Happy Independence Day! FUELSNews will resume on June 8.

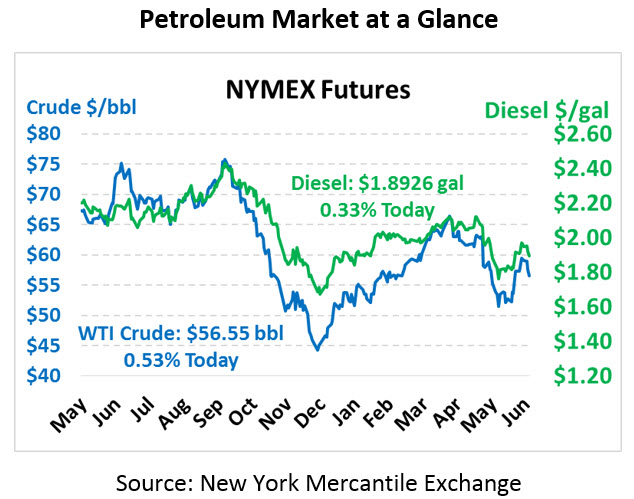

Prices shed almost $3/bbl yesterday as markets reacted strongly to bearish industrial data in Europe and Asia as well as American manufacturing slowing to a 3-year low. A bullish API report gave the market a temporary lift this morning, but the EIA’s market data has prices barely clinging to positive gains. Crude oil is currently trading at $56.55, up 30 cents from yesterday’s close.

Fuel prices are slightly higher, with gasoline particularly seeing moderate gains. Diesel prices are trading at $1.8926, up 0.6 cents from yesterday’s close. Gasoline prices are currently $1.8850, up 1.5 cents.

Yesterday’s sell-off came amid a wave of economic reports that showed weaker activity, though concerns regarding the OPEC deal continued to weigh heavy. Markets are wrestling with OPEC’s seemingly small cuts, which could help shave off some of the excess inventories, and their ambitious claim of returning global inventories to 2010-2014 averages. OPEC is now explicitly trying to manage the rise of American production, but their strategy of propping up high prices only incentivizes further US exports. Until OPEC clarifies their strategy, markets are skeptical of any long-term impact on supply impact beyond small inventory draws.

The EIA’s data is being interpreted as bearish across the board, with crude draws limited to just 1.1 MMbbls (vs -3 MMbbls expected) and diesel showing a surprise build. The fact that inventories were still down is surprising given how off exports and imports were this past week. Last week, net outflow skewed extremely low; this week it jerked in the other direction, with imports up 930 kbpd and exports down 780 kbpd. It’s worth noting that PADD 1 was a big driver this week for both crude and gasoline inventories; the PES refinery outage kept crude stuck in storage and forced a hefty drawdown in gasoline inventories.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.