Oil Sheds 2% on OPEC Uncertainty

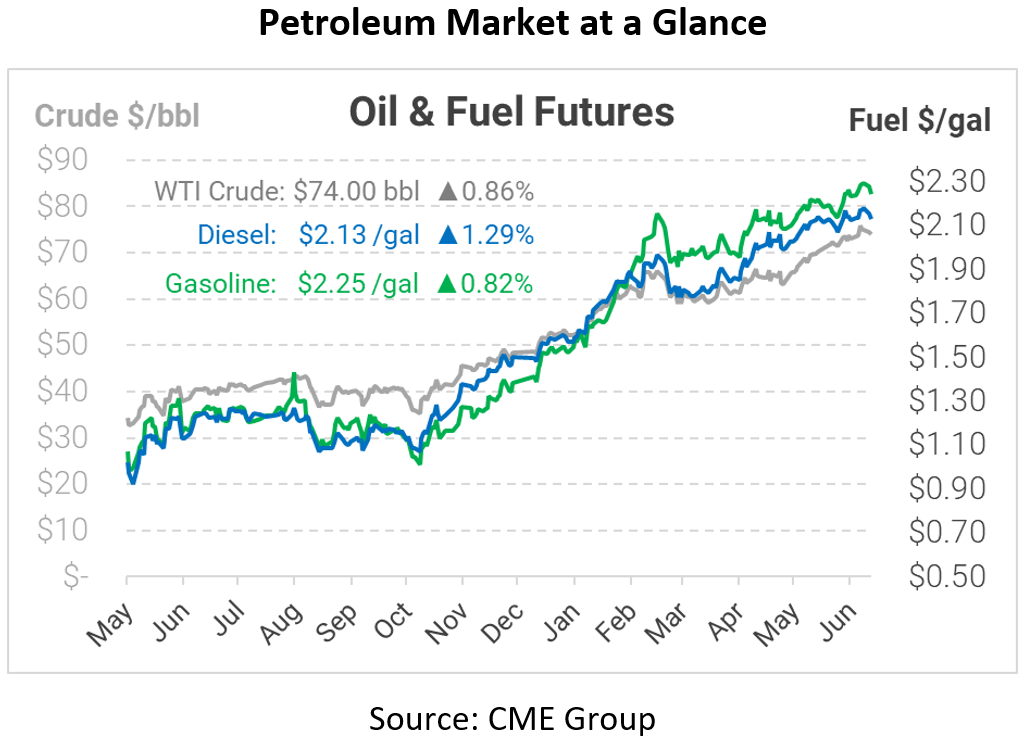

Oil prices faced a large selloff yesterday, with crude prices shedding nearly $1.80 (2.4%) from their opening price. Fuel prices saw an even steeper decline, with diesel down 3.4% and gasoline losing 3.1%. After OPEC+ canceled their meeting, markets seem to be pricing in some possibility of the entire 5.7 MMbpd cut agreement unwinding, which would cause member companies to expand production to grow market share. Although a very low probability, uncertainty is fueling price volatility. This morning, traders are buying the dip, recouping a third of yesterday’s losses.

Even as prices gyrate near multi-year highs, US producers have shown a high degree of restraint. Previously seen as the global swing producer, ramping up supply whenever prices rise too high, US shale is now holding the line. Oil companies could sell futures to lock in high oil prices for 2022 and beyond, but producer hedging for 2022 seems to be focused on maintaining existing levels, not growth. In particular, oil investors seem to want companies to accept more risk – providing more shareholder upside if oil prices rise but losses if prices crash once again.

The API’s data is a day delayed this week due to the holiday weekend. Markets are expecting a 3.9-million-barrel drop in crude stocks, in line with previous weeks. On the gasoline side, markets are closely watching inventories this week. While diesel and crude stocks have returned to the 2015-2019 historical average, gasoline stocks have risen above the five-year range as refiners increase their utilization. With US drivers hitting the road for the July 4th weekend, markets are anticipating a draw to bring gasoline inventories closer to the average.

This article is part of Daily Market News & Insights

Tagged: crude, Futures, gasoline inventories, opec

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.