Oil Sets New Highs on COVID Relief Bill

Oil climbed once again to a new high yesterday, settling over $53.50/bbl as the market rally continues. This morning, prices are tumbling lower as traders take in their profits and lockdowns continue to be implemented. Fuel buyers are also beginning to feel some of the pre-COVID price pain, with both diesel and gasoline setting their own multi-month highs ($1.619 and $1.554, respectively). Corporate fuel buyers who locked in their fuel prices when fuel was under a gallon are now enjoying below-market costs, while those exposed to the market face a continued uphill march for prices. (If rising prices impact your budget, it never hurts to explore your risk management options and seek a no-obligation fixed price quote).

Yesterday, President-Elect Biden unveiled his COVID relief package, which will spend $1.9 trillion to stimulate the US economy. The legislation includes an additional $1,400 in stimulus checks for US households and $400 billion for vaccine distribution. It also provides funds for small businesses, COVID testing, and schools. The bill will help Biden meet his promise of delivering 100 million vaccine shots (50 million people treated) in the first 100 days of his administration. With control of both houses of Congress, Biden should be able to get his proposal enacted, though it may face some scrutiny and modifications as it passes through Congress. Markets soared yesterday on the stimulus news, but this morning the focus is on short-term struggles.

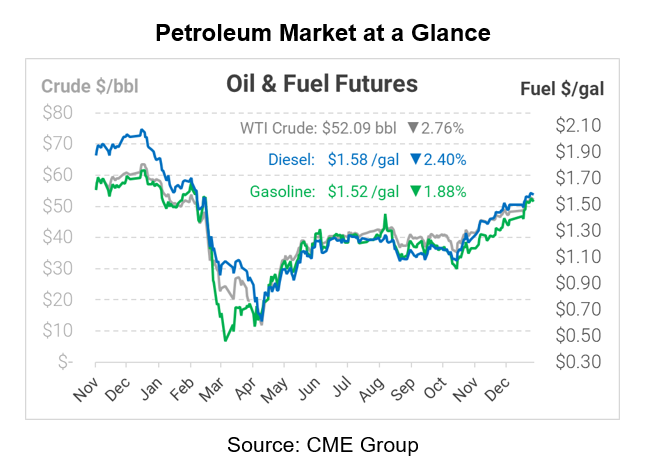

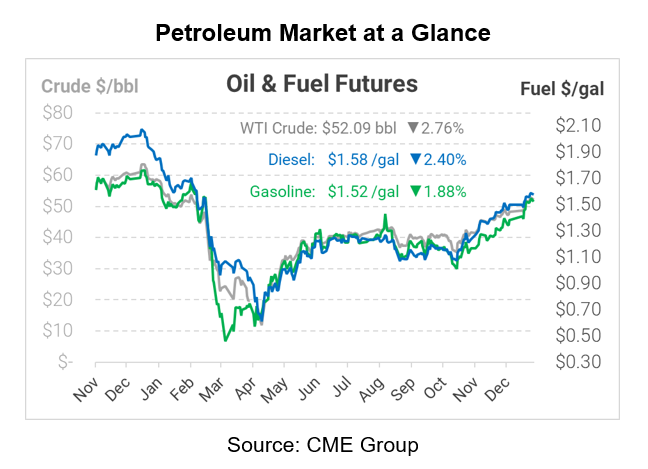

Crude oil is currently trading substantially lower than yesterday, a reversal of a week of gains. WTI crude is trading at $52.09, down $1.48 from yesterday’s closing price.

Fuel prices are also sinking. Gasoline is trading at $1.5247, down 2.9 cents. Diesel prices are currently $1.5805, down 3.9 cents since yesterday.

This article is part of COVID-19

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.