Oil Prices Nearly Normal (And What “Normal” Means Now)

US oil prices are rapidly approaching the $40/bbl mark thanks to an agreement by OPEC’s largest producers to extend cuts through July; OPEC members will meet Saturday morning to memorialize the agreement. The $40/bbl threshold is particularly significant for two reasons:

- Crude oil markets rarely dip below $40/bbl. When they do, it typically doesn’t last long. However, 2015-17 showed that $40-$50 is a comfortable range for oil prices over a prolonged period. While we have a long way to go getting back to normal, oil is finally nearing a sustainable level.

- Closely related to the first point, $40/bbl is often cited as a critical threshold for American shale production. Below that level, drilling new wells is cost-prohibitive, and even continuing existing wells may generate losses. As prices surface above $40/bbl, more shale production could begin coming back, breathing life into an industry currently on life support.

Assuming no second-wave of coronavirus (and any resulting economic shutdown), the path towards normalized oil and fuel prices seems inevitable now. Yet a critical question remains – how long will we stay at the low end of normal? Looking at the past decade of crude oil prices, $40 crude is at the low end of the spectrum. Some analysts have forecast $100 crude oil in 2021 if production remains low but demand jumps back. These claims seem far-fetched right now, yet they highlight just how uncertain the future remains. Markets face unprecedented downside and upside risk, making fuel price risk management more challenging than ever.

The fast return to $40 is even more surprising considering the events of the past month. In May’s Short-Term Energy Outlook report, the EIA forecast WTI would not hit $40/bbl until April 2021. Compared to last month’s thinking, markets shaved off a full year of price recovery! The disparity highlights the volatility of the current situation, as well as the potential for further gains. Before the pandemic struck, WTI was trading at $60/bbl, and geopolitical tensions created fears of prices shooting to $70/bbl or higher. While economies have much recovery work to do, that price level may not be out of reach in the coming 18 months.

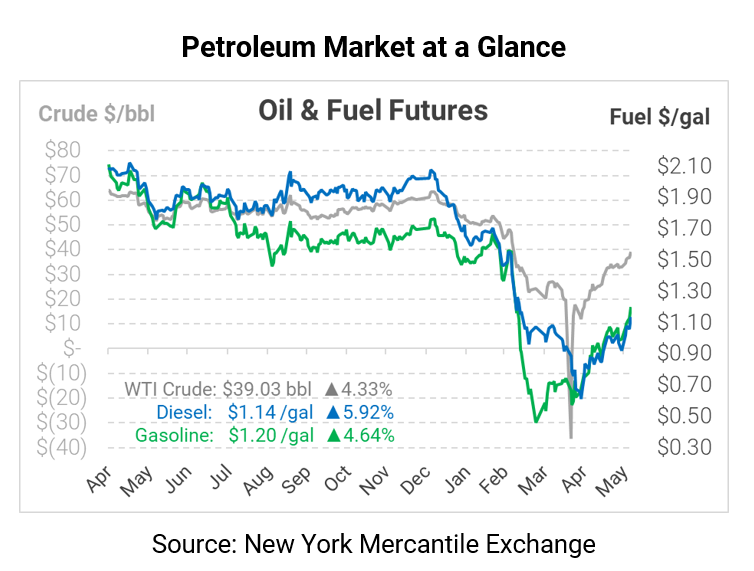

Crude oil began the morning with lofty gains, reaching a high of $39.57 before retreating. WTI prices are currently $$39.03, an increase of $1.62 (+4.3%).

Fuel prices are also experiencing heavy gains, despite large inventory gains this week. Diesel prices are trading at $1.1377, up 6.4 cents (+5.9%) from Thursday’s closing price. Gasoline prices are trading at $1.2023, up 5.3 cents (+4.6%).

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.