Oil Prices Are All About China Today

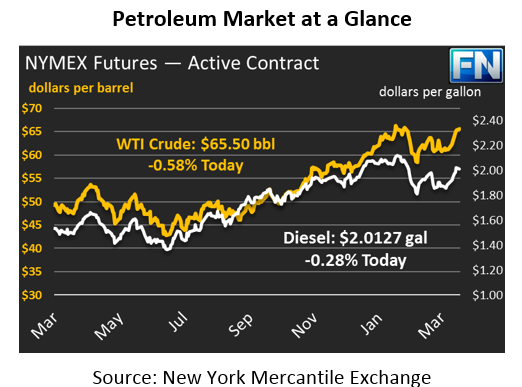

After losing ground on Thursday, prices picked up some notable gains on Friday, WTI crude prices up $1.50 (2.5%) relative to the previous day. Prices closed at $65.88. Today, prices have lost a bit of ground, though the overall sentiment appears friendly towards prices remaining high. Crude prices this morning are down 38 cents, trading at $65.50.

Fuels saw less significant gains, with gasoline prices rising 1.2% and diesel rising 1.3% on Friday. Today, both products are in the red, trading lower in sympathy with lower crude prices. Diesel prices are currently down half a cent at $2.0127, while gasoline prices are down 1.5 cents at $2.0186.

The end-of-week rally came as markets continued to parse through uncertainty regarding foreign policy. Bolton’s appointment to National Security Adviser will certainly add an element of risk and aggressive action to U.S. foreign policy. Political pundits have announced the Iran Nuclear Deal is virtually dead, which could create huge shockwaves for markets. Of course, Trump has never been good at following the suggestions of his advisors, so maybe he’ll reverse course and take a calmer tone? Doubtful, but it’s nice to hope for.

Stock markets are rallying this morning as the U.S. and China announced trade talks to work through the recent spew of tariffs and other trade barriers. A trade war would be detrimental to both countries, so they are working through plans to improve trade once again. China has already indicated willingness to purchase more semiconductors from the U.S. to lower the trade deficit. As markets calm from fears of a U.S.-China trade war, oil prices should rise a bit higher – a trade war would have reduced trade and oil demand, causing prices to fall.

Today China’s oil futures market launched, prompting numerous speculative articles on its future impact on global currencies, energy, and production. In the short- to medium-term, the market’s debut will be positive for Chinese producers and refineries, who can use yuans to buy futures contracts and avoid currency risk. It will be years, however, before the Chinese energy market rivals the U.S. or London indexes.

Both WTI and Brent blend crude oils are light and sweet, meaning they have a low density and low sulfur content. These qualities make them ideal for blending into fuels. China’s Shanghai blend will be medium-sour, which is less popular in global markets. Investors are also hesitant about using Chinese currency, making it challenging to acquire the currency needed to buy Shanghai futures. While the new market may eventually help China become a key player in energy markets, they have numerous structural challenges to overcome before their crude futures index is competitive with Brent and WTI.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.