Oil Near One-Week High – US Drillers Add Oil & Gas Rigs

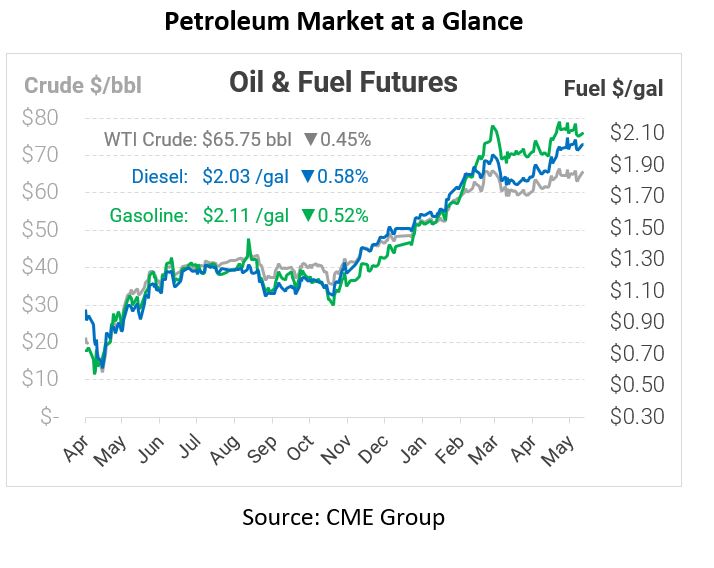

Today oil prices fell from the one-week highs set yesterday. Oil rose more than 3% above last week due to faltering US-Iran negotiations. Crude futures were down 20 cents, and US West Texas Intermediate futures were off 29 cents after attaining near 4% gains on Monday.

This week in Vienna, the United States and Iran hope to continue indirect conversations about various nuclear topics. Investors have mixed feelings about what to expect, but the majority do not believe a complete nuclear agreement will be reached in Vienna. Iran is top of mind for bearish investors while recovering demand following the pandemic still provides bullish support. Uncertainty for oil demand is causing trader caution at the current pricing levels. The release of this afternoon’s API inventory report may help yield insights into the current state of supply and demand.

United States energy firms added oil and natural gas rigs for a fourth week in a row. This is due to higher oil prices encouraging drillers to tap new wells. The total oil and natural gas rig count rose to 455 the week of May 21, an increase of two and its highest since April 2020. Compared to one year ago, the total rig count was up 43%, an increase of 137 rigs; rigs were up 86% from their August 2020 low. This week, US oil rigs rose to 356, an increase of four from last week.

This article is part of Daily Market News & Insights

Tagged: Futures, Iran, oil demand, rig count

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.