Oil Inventory Build Weakens Rally

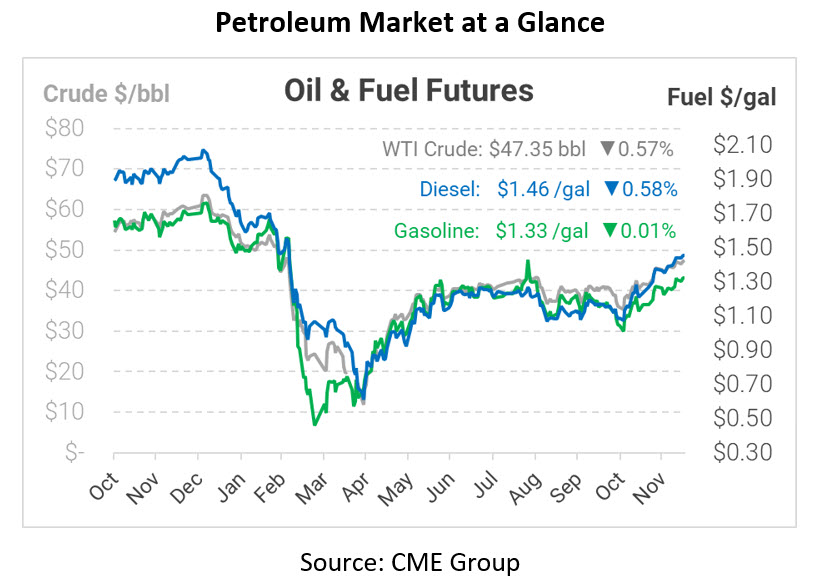

Fuel markets climbed to yet another high to end yesterday’s trading session, putting the US crude contract at a whopping $47.62/bbl. Like many other mornings this week, trading is flat/lower. For the last two weeks, those types of mornings have either resulted in a flat trade or a moderate gain, but the EIA’s weekly petroleum report will likely be the ultimate authority for the market today.

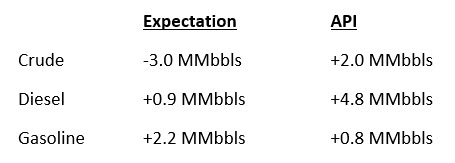

The API yesterday reported across-the-board builds, halting upward momentum. Crude posted a 2 million barrel build, compared to an expected withdrawal. Refined products were expected to rise this week and did not disappoint, but diesel’s 4.8 MMbbl build will give markets plenty to think about. Diesel demand is close to historically normal levels, so builds suggest a potential supply problem, rather than demand. We’ll find out for sure once the EIA releases its more authoritative weekly data on supply, demand, and inventories.

The oil complex is trading slightly lower this morning, with traders waiting for further input before making any major directional moves. WTI crude is trading at $47.35, down roughly a quarter from yesterday’s closing price.

Fuel markets are also gently falling. Diesel is trading at $1.4559, down 0.9 cents from yesterday’s close. Gasoline is trading at $1.3267, hardly changed at all.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.