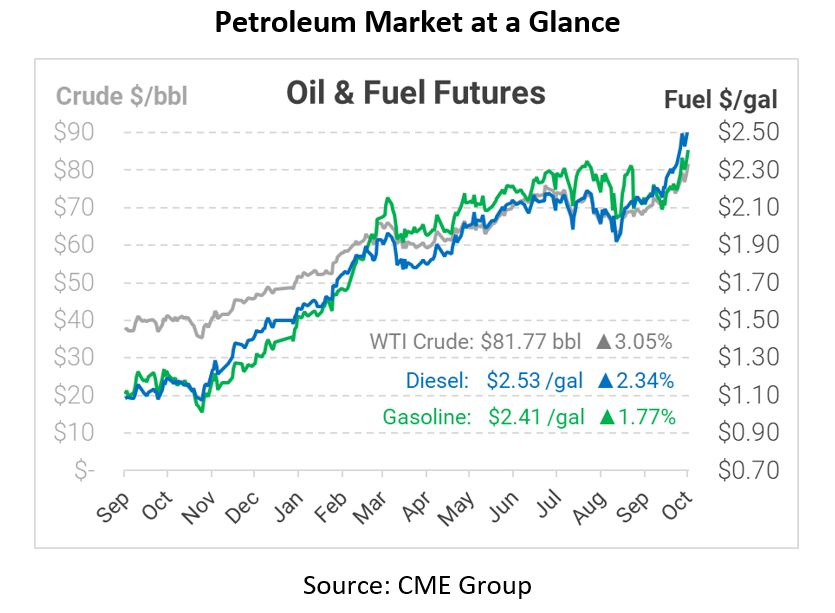

Oil Hits Highest Prices Since 2014

This morning WTI crude oil extended its climb when it broke the $80 mark, once again becoming the highest prices since 2014. Since last October, oil has climbed over 120%, shocking consumers who have experienced historic fuel prices. This morning crude opened at $79.59, diesel opened at $2.4743, and gasoline opened at $2.3745.

The rise in oil prices continues as many countries around the globe remove lockdown restrictions and vaccinate their populations. With countries recovering fast and expecting a particularly cold winter, energy supply is finding it hard to keep up. This has put more pressure on OPEC+ governments, with many countries pleading for the cartel of oil producing nations to help neutralize the oil price spike. Adding to the pain, the United States Department of Energy stated last week that, for now, they are not planning to tap into the strategic reserves, keeping oil prices even tighter.

While the administration was considering tapping into reserves to neutralize price threats, they have stated that the department has “no plans to take action at this time.” The positive is that OPEC+ agreed to continue increasing output to help curb the abrupt price changes, but will this be enough? For the most part, we have seen gradual increases from OPEC+ over the past few months, but many argue that this is doing nothing to help bring oil prices dramatically down. All one can do now is wait, as prominent world leaders meet up in November at the United Nations Climate Change Conference in Scotland to see if any significant plans are set up to help the price scare and discuss global energy transformation.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.