Oil Continues Following Equities Lower

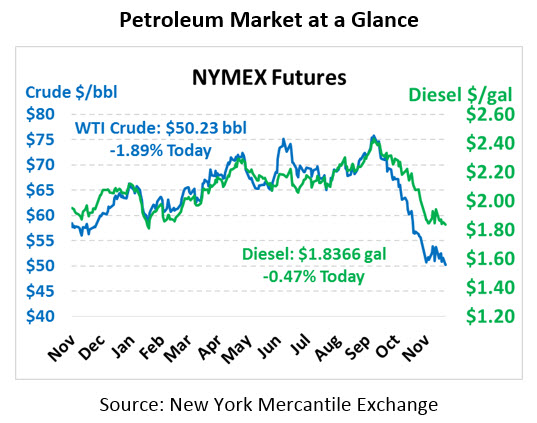

Friday brought yet another sell-off, which combined with this morning’s losses has brought crude oil back to the $50 threshold. Crude is currently trading at $50.23, a loss of 97 cents since Friday’s close.

Fuel prices are also trading a bit lower. Diesel prices are $1.8366, down 0.9 cents. Gasoline prices are down to $1.4258, also 0.9 cents lower.

With the stock market turning lower once again, commodities are tracking down as well. Regardless of improving fundamentals, markets are focused on economic conditions. Economic media is increasingly focused on the probability of a recession in 2019 or 2020. Morgan Stanley sets the odds of a recession in 2019 at 15%, while a 2020 recessions has 30% likelihood. Others see a recession as even more likely; former Treasury Secretary Larry Summers thinks there’s a 50% chance of a recession over the next two years.

Import data shows South Korea has not imported any crude oil from Iran in three months, despite receiving waivers from the US. After the US imposed sanctions on Iranian oil, they granted waivers to a few countries, including China, India, and South Korea. South Korea is one of Iran’s main Asian buyers, buying roughly 150 kbpd earlier this year. Although not enough to significantly alter oil prices, the cuts show sanctions are having an effect on purchasing decisions.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.