Oil Companies Fight for Permian Control

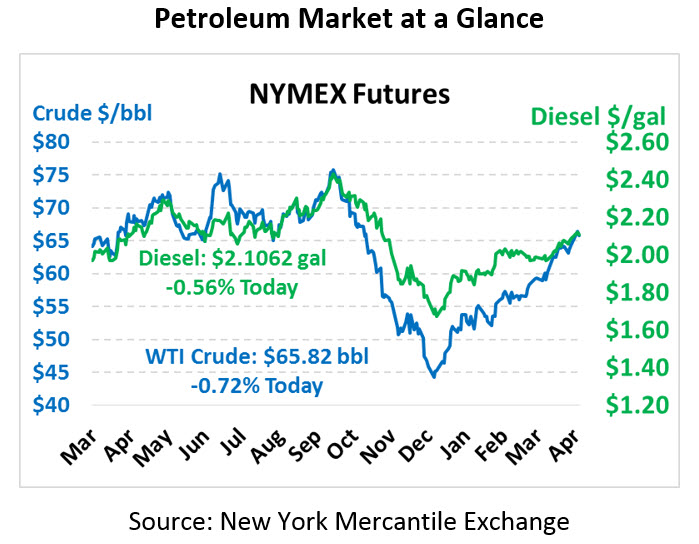

Oil markets sustained moderate gains yesterday thanks to OPEC reports of continued cuts, and this morning they’re trading roughly flat. Crude oil is currently trading at $63.89, unchanged from yesterday’s close.

Fuel prices are trading slightly higher on a supportive API report. Diesel prices are currently trading at $2.0888, up 1.1 cents from yesterday’s close. Gasoline prices are at $2.0785, up 1.2 cents. With the roll to June contracts, diesel prices are once again trading higher than gasoline as markets get closer to IMO 2020’s hefty increase in distillate demand.

The API’s report release yesterday afternoon revealed a hefty headline build of 6.8 million barrels for crude inventories, though products were more in line with expectations. Gasoline stocks fell right in line with expectations, while diesel fell 2 million barrels below expected drops. The EIA’s report will confirm whether API numbers are accurate.

Oil Companies Fight for Permian Control

Oil companies are going to war over access to the Permian – and now a financial giant has joined the fight. In April, Chevron made a $33 billion bid on leading oil and gas producer Anadarko. Anadarko has a strong presence in the US, with nearly 450 kBOE/d of output in onshore production alone. Both parties agreed to the deal, which seemed to be an affirmation that the Permian will remain a prolific region for years to come. Two weeks later though, Occidental Petroleum (a global oil and gas exploration/production company), offered $38 billion. This week it was discovered that the investing legend Warren Buffett is backing Occidental with $10 billion of capital.

Years ago, companies raced into the Permian to grab land; it appears that land-grab is far from over. For consumers, this huge purchase shows that oil majors are hungry to expand in the Permian region, betting heavily on US energy exports. As US energy grows, countries like OPEC will have a harder time influencing prices for consumers, though the question remains whether US producers can sustain $45-$50 break evens over the next several years.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.