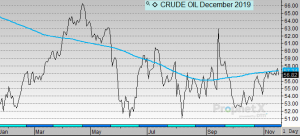

Oil Briefly Above 200-Day Moving Average

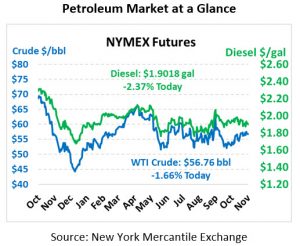

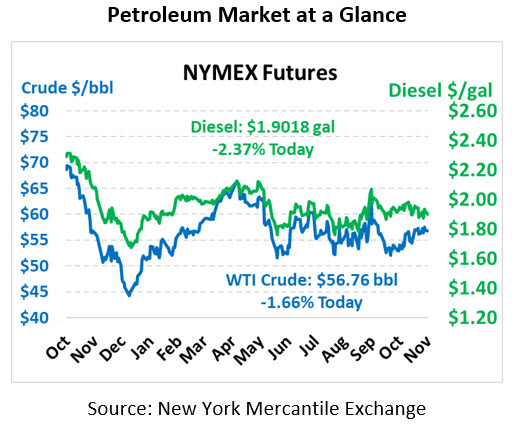

Once again a large price swing is being negated this morning as markets are driven by headlines rather than fundamentals. Crude oil is trading at $56.76, down 96 cents (-1.7%) from Friday’s close.

Fuel prices are taking a hit as well. Diesel prices are trading at $1.9018, down 4.6 cents (-2.4%). Gasoline prices are currently $1.6037, down 3.1 cents (-1.9%).

Friday saw prices leap higher after crude oil prices leaped above the 200-day moving average (blue line) for the first time since September’s attack on Saudi oil production. The rally was short-lived, though, leading prices to retreat this morning. The 200-day moving average is a popular technical indicator for financial markets indicating strong momentum – the struggle to surpass this threshold for the past few months points to a weak disposition for traders.

Over the weekend, Chinese sources pointed to progress on trade negotiations, but so far there’s been few details to back up these assertions. Notably, China’s central bank cut its lending rate by a very small amount this morning, which countries do when worried about weak economic prospects in the future. The US Federal Reserve has been cutting rates since July of this year. Analysts now speculate that China may be on a new path of rate-cutting to protect the country from the US-China trade war. If so, this may give China more strength to continue waging the war with the US.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.