Natural Gas News – April 2, 2019

Natural Gas News – April 2, 2019

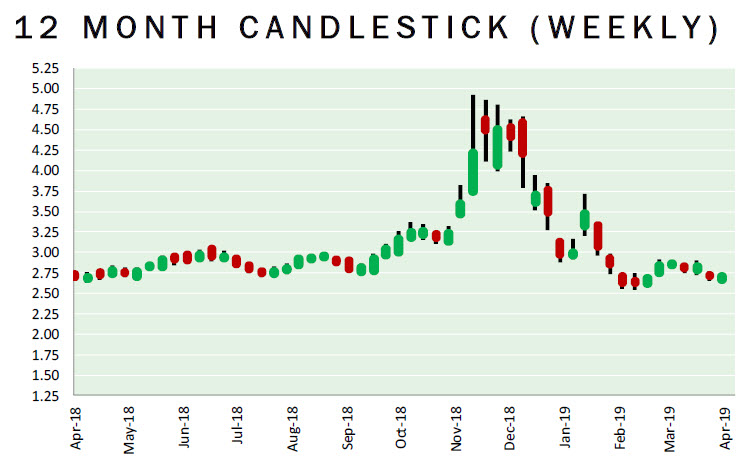

Natural Gas Price Up 10%; ONGC Posts 6.5% Rise In Gas Production

Business Standard reported: Giving a boost to producers such as Oil and Natural Gas Corporation (ONGC) and Reliance Industries (RIL), the price of domestic natural gas in India has increased by 10 per cent to $3.69 per million metric British thermal units (mmBtu) for the April-September period, compared to $3.36 per mmBtu during October to March period. Producers will be able to charge a maximum of $9.32 per mmBtu for difficult fields, posting an increase of about 22 per cent from $7.67 a unit during October-March. This includes gas produced from discoveries in deepwater, ultra deepwater and high-pressure-high temperature areas. The price of domestic natural gas is decided after every six months, based on a formula, taking into account average rates from international trading hubs.

Shell Enters Into 20-Year Deal With Rio Grande LNG

Houston Chronicle reported: The liquefied natural gas arm of oil giant Shell has become the first customer at NextDecade’s proposed $15 billion Rio Grande LNG export terminal at the Port of Brownsville. NextDecade announced the 20-year sale and purchase agreement at the LNG2019 conference in Shanghai on Monday night. Under the deal, Shell will buy 2 million metric tons of LNG per year from the proposed Brownsville facility starting in 2023.”We are honored to have Shell as the first foundation customer of our Rio Grande LNG project,” NextDecade CEO Matt Schatzman said in a statement. “Shell is not only the largest portfolio LNG company in the world, Shell is also a recognized pioneer in the global LNG business.” NextDecade has already obtained a state permit but is still seeking permission from the Federal Energy Regulatory Commission to build a liquefied natural gas export terminal along the Brownsville Ship Channel.

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.