Multi-Year Record Data Restores Hope of V-Shaped Recovery

On Tuesday, WTI crude closed slightly higher as US equities closed at new record highs and drew crude along with them. The S&P 500 and the Nasdaq reached new record highs yesterday and the Dow added 200 points for the three major indices to close with gains. The rally was spurred by bullish manufacturing data in both the US and China. The US posted its fastest monthly manufacturing expansion in two years, while Chinese manufacturing grew by the largest amount in nearly a decade. Stock markets interpreted the data as signs of a possible V-shaped recovery, meaning the economy is bouncing back quickly to pre-pandemic levels.

Adding to the bullish oil sentiment, the API showed a larger-than-expected draw in crude and products. Hurricane Laura last week shut in Gulf Coast oil production and refinery activity, causing an overall slowdown in American oil output. Saudi Arabia also continues slashing deliveries to the US in an effort to manipulate international prices by affecting the world’s most transparent market. Despite the robustly bullish news yesterday, WTI crude could not break through the upper limits of its $39-$43 range, where it has been capped for months by demand concerns.

In regional news, some effects from Hurricane Laura continue to be felt this week. Power outages are affecting some terminals near Lake Charles, LA. While line crews are in the area making repairs, it is unknown at this time how long the power will be offline in these areas.

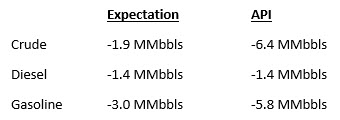

The API’s data last night:

The API reported a larger-than-expected draw for crude of 6.4 MMbbls versus an expected draw of 1.9 MMbbls. At Cushing, stocks decreased by 0.2 MMbbls. The API reported that distillates had a decrease in stocks in line with expectations. Gasoline inventories had a large draw. The EIA will report numbers later this morning.

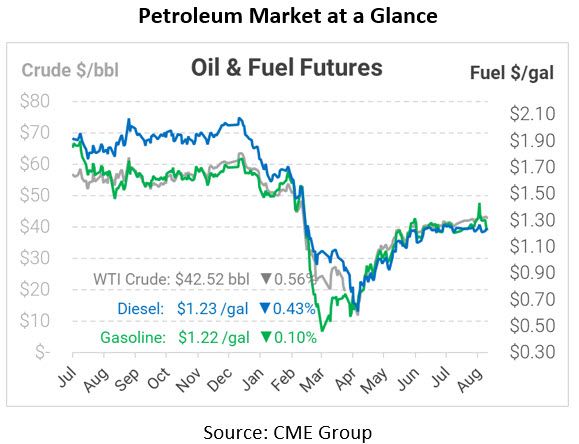

Crude prices are down this morning. WTI Crude is trading at $42.52, a loss of 24 cents.

Fuel is down in early trading this morning. Diesel is trading at $1.2255, a loss of 0.5 cents. Gasoline is trading at $1.2235, a fractional decrease.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.