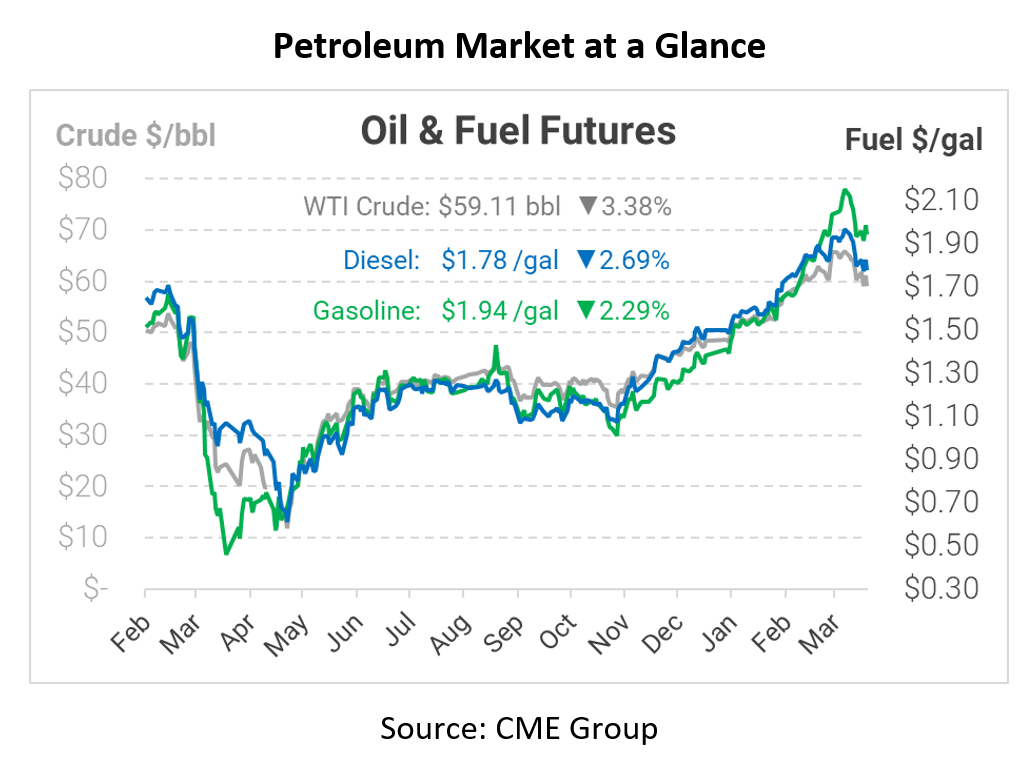

More Volatility from Suez Blockage and EIA Report

A few days ago, we commented that WTI crude prices had not closed below $60 for two consecutive sessions since Feb 12. Bullish traders must have heard that as a challenge, and they joined together to push oil prices almost $3.50 higher during yesterday’s session. The frenzy of buying and selling now could give one whiplash – $2/bbl or more gains and losses are becoming the norm, rather than the exception. Diesel prices rose 8 cents, and gasoline picked up a whopping 10 cents yesterday. Today, crude oil is seeing another $2/bbl move, this time lower. With volatility like this, now’s a great time to evaluate market price risk and its affect on your business.

Contributing to yesterday’s rally was a blocked ship in Egypt’s Suez Canal, which connects the Mediterranean Sea to the Red Sea (and thus connects the Atlantic to the Indian Ocean). The cargo ship was turned sideways on Tuesday by heavy winds and a sandstorm. Wood Mackenzie estimates that 16 oil tankers are being held up in the process. The EIA has noted that 1.1 million barrels of oil pass through that canal daily. The Suez Canal connects many Middle Eastern countries (including Saudi Arabia, Yemen, Iran, and Iraq) to the Western Hemisphere, so the blockage has severely impacted both oil and commercial trade flows.

The EIA’s weekly oil report showed another across-the-board build, which is throwing markets into a bearish frenzy this morning. In particular, the hefty diesel build shows that refinery runs are back. Refinery utilization rose to 81.6% this week, joining the handful of weekly reports from the past year that have been over 80%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.