Missile Strikes on Iranian Tanker

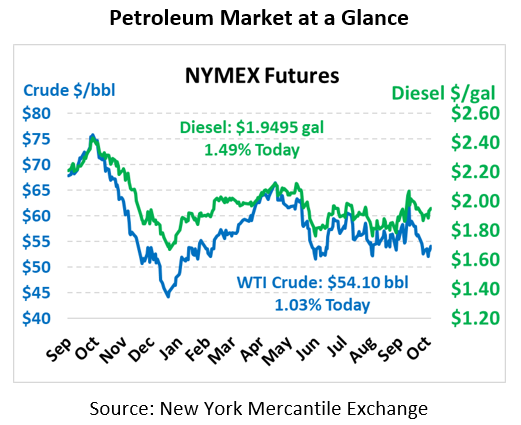

Markets closed higher yesterday on news from OPEC regarding production cuts, and this morning headline declaring missile strikes on an Iranian tanker are continuing the gains. Crude oil is currently trading at $54.10, up 55 cents.

Fuel prices are also higher this morning, with diesel leading the complex higher. With inventories falling quickly and IMO 2020 approaching, diesel prices are showing strength. Diesel is trading at $1.9495 this morning, up 2.9 cents. Gasoline is trading at $1.6347, up just 1.1 cents.

This morning, Iran media declared that an Iranian oil tanker was struck by two missiles while travelling in the Red Sea near Saudi Arabia, giving markets some concerns about geopolitical risk in what has recently become a tinderbox of geopolitical instability. While Iran has not yet identified the perpetrator, early signs point to the missiles originating from Saudi Arabia soil, according to some Iranian sources. The resulting oil spill was reportedly repaired quickly, and the ship remains en route to its destination. Prices initially jumped above $54/bbl, and if they maintain that level it will be the highest closing price since September.

With the attack seemingly contained, markets are turning their attention this morning to an IEA report which once again decreased demand forecasts for 2020 amid economic concerns. The report also highlighted the Saudi supply situation, noting that global supply markets have quickly rebounded from the outage. Between abundant and robust supply networks and weakening demands, oil price forecasts for 2020 seem gloomy, absent geopolitical risk factors.

Yesterday, markets received a boost from OPEC leader Mohammad Barkindo, who stated he would do “whatever it takes” to prevent lower oil prices from returning. He indicated that December’s OPEC meeting could result in decisions that help stabilize prices in 2020. OPEC has been playing the global swing producer since 2017, and earlier this year Saudi officials confirmed the group’s approach may become a permanent fixture of the global supply environment. When OPEC began teasing the market in 2016 with supply cuts, prices began reacting by moving higher. Whether markets will respond in the same way this time around is yet to be seen.

This article is part of Crude

Tagged: 2020, economic concerns, IEA report, IMO 2020, Iran, Mohammad Barkindo, oil pricing, oil tanker, opec, Red Sea, Saudi Arabia

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.