Markets are Rebounding from Rising Pressures

On Wednesday, WTI crude was down sharply on news from the EIA of a surprise build in gasoline stocks which is a proxy for gasoline demand. Rising coronavirus cases in the US and Europe are causing concern around a second wave of lockdowns and restrictions putting a dent in demand recovery. According to the EIA, total products supplied over the last four-week period averaged 18.3 million barrels a day, down by 12.9% from the same period last year. Over the past four weeks, motor gasoline product supplied averaged 8.6 million barrels a day, down by 8.7% from the same period last year.

On the supply side, the return of Libyan barrels to the international market is a cause for concern. The already oversupplied market is being held in check by OPEC+ supply cuts of 7.7 MMbpd. Libya is beginning to supply up to an additional 500 kbpd to the market that will need to find a home. The excess supply put downward pressure on the market this week, but crude is recovering somewhat in early trading this morning.

The EIA reported a decrease for crude of 1.0 MMbbls, in line with expectations of an expected increase of 1.0 MMbbls. At Cushing, the EIA reported that stocks increased by 1.0 MMbbls. US crude oil inventories are about 10% above the five-year average for this time of year. Distillates reported a draw and continue to trend roughly 19% above the five-year average. Gasoline inventories had a build and are about 2% above the five-year average.

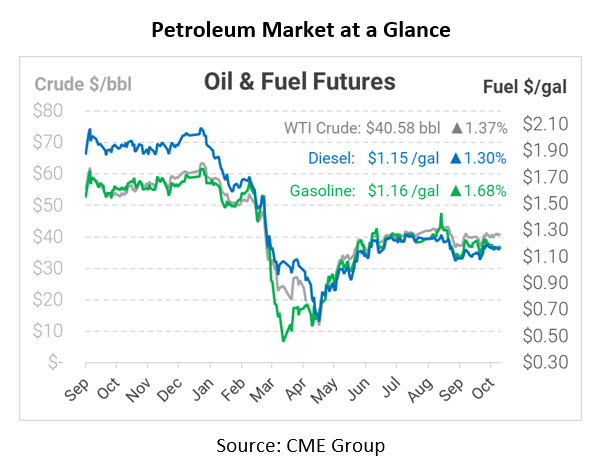

Crude prices are up this morning. WTI Crude is trading at $40.58, a gain of 55 cents.

Fuel is up in early trading this morning. Diesel is trading at $1.1547, a gain of 1.5 cents. Gasoline is trading at $1.1595, an increase of 1.9 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.