Market Falls Despite Cushing, OK Crude Draws

Oil markets fell lower yesterday, as the EIA’s inventory report proved slightly bearish for markets and as equity markets fell. Crude prices lost over a dollar yesterday, with prices sinking $1.15, or 1.8%, lower. Today, oil prices are continuing their decline, thanks to significant positive strides from the dollar over the past few days. Crude prices are currently $61.19, a loss of 45 cents (0.7%).

Fuel prices also fell, with diesel prices falling 4.5 cents while gasoline fell more than 5 cents. Today, diesel prices are currently $1.8892, trading 1.4 cents (0.8%) lower than yesterday’s close. Gasoline is also trading lower, with prices currently at $1.9165, a loss of 0.8 cents (0.4%).

Gasoline prices are an interesting case this morning, since yesterday’s gas price was in the $1.70 range and today’s price is over $1.90. Why the huge increase? Remember that NYMEX prices are futures, so analysts typically report on the prompt (upcoming) month price. Yesterday, the March contract expired, and today “prompt month” rolled to April, when summer gasoline requirements begin. Because summer gasoline costs more to produce, it trades at a higher level than winter gasoline. Interestingly, the April contract fell over five cents yesterday, so despite the large perceived increase in prices, gasoline prices actually fell yesterday. It’s worth noting that gasoline prices are currently higher than diesel prices, which is normal during the summer.

The EIA released their weekly inventory report. Markets expected the crude inventory build, but were surprised that gasoline inventories also rose. The gasoline build was especially surprising in the face of falling refinery run rates, which continued falling to 87.8% utilization last week. Very low export levels, mixed with weaker demand and rising imports, helped to generate the gasoline build. The surprise build led gasoline markets to give up 5 cents yesterday, a loss of 2.7%.

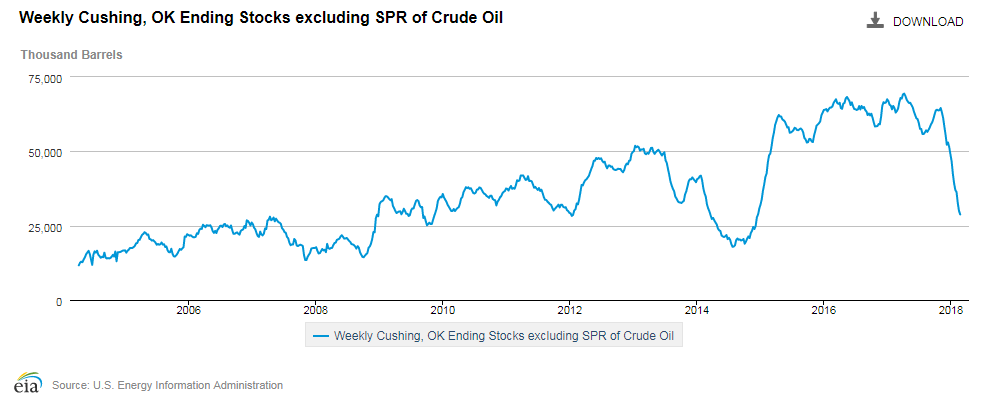

Markets are closely watching the drawdown in stocks at Cushing, OK, the delivery point for WTI crude oil. If supply in Cushing is low, it directly impacts WTI prices, even if not significantly altering other crude indexes such as Europe’s Brent crude. Cushing inventories are at their lowest point since 2014, far below their high 2016 levels.

The inventory imbalance is caused by two pipelines. First, the Keystone Pipeline has not yet reached full capacity since leaking last year. Keystone brings Canadian crude down to Cushing, so a significant portion of crude has been stranded in Canada until the pipeline becomes fully operational (or until Keystone XL is completed). Second, the Diamond Pipeline was completed in December 2017 and has been transporting approximately 150 kbpd of crude out of Cushing stocks and towards Memphis, TN. Lowered supply, mixed with new demand for Cushing inventories, has caused the steep withdrawal that has kept WTI crude price elevated.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.