Major Shale Fracker Declares Bankruptcy

Tumultuous energy prices have sent fuel buyers on a wild ride, one which has been generally favorable – at least for the procurement team. But the companies on the other side of the equation, the oil producers and processors, have suffered from the collapse.

Last week, shale oil producer Chesapeake Energy succumbed and declared bankruptcy, marking one of the largest companies to fall as the shale oil boom fades. Chesapeake was co-founded by Aubrey McClendon, a renowned wildcatter at the forefront of the shale revolution. A leader in experimentation with horizontal drilling and fracking, the company grew through heavy debt accumulation to fund its drilling, requiring massive restructuring when current CEO Doug Lawler took the helm seven years ago.

Chesapeake is not alone – Bloomberg reports that, since January, nearly three dozen US producers have declared bankruptcy. At the same time, US rig counts fell to their sixth consecutive record low this past week, as five more rigs were idled to bring total deployed rigs to just 279. A year ago, there were nearly 1,000 rigs in operations. And that number is still 279 times as many rigs as are left in Venezuela, where a single oil rig is left to tap the world’s largest oil reserves.

Oil prices are suffering this morning as countries including China, Russia, and the US report rising incident counts of COVID-19. Beijing saw 79 cases pop up, mostly related to an incident at a wholesale food market, while on Saturday the US reported 25,000 new cases of COVID-19. Markets fear a resurgence could jeopardize gains already made in reopening economies.

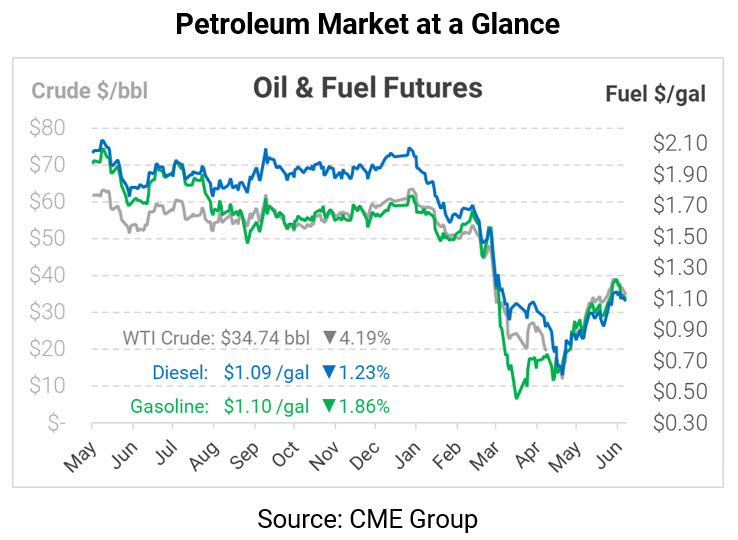

Crude oil prices are experiencing heavy losses, though those losses are mostly limited to the crude product. WTI crude is trading at $34.74, a loss of $1.52 (-4.2%) per barrel.

Fuel prices are trading lower but have yet to follow crude’s more bearish track. Diesel prices are currently trading at $1.0878, down 1.4 cents (-1.2%) from Friday’s closing price. Gasoline prices are $1.1034 this morning, down 2.1 cents (-1.9%).

This article is part of Daily Market News & Insights

Tagged: COVID-19, Fracking, US production

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.