JP Morgan: “Sky Is the Limit” for Distillates

With US crude oil closing above $80/bbl for the first time since 2014, sentiments are shifting against the alliance of 14 oil-producing countries – known as OPEC+ – keeping the brake on output. The White House has been calling on OPEC+ to increase supply for months, and many new headlines and analysts are joining the frey. Commerzbank reported an acute, short-term supply tightness, adding that the shortage will last “[f]or as long as OPEC+ appears unwilling.”

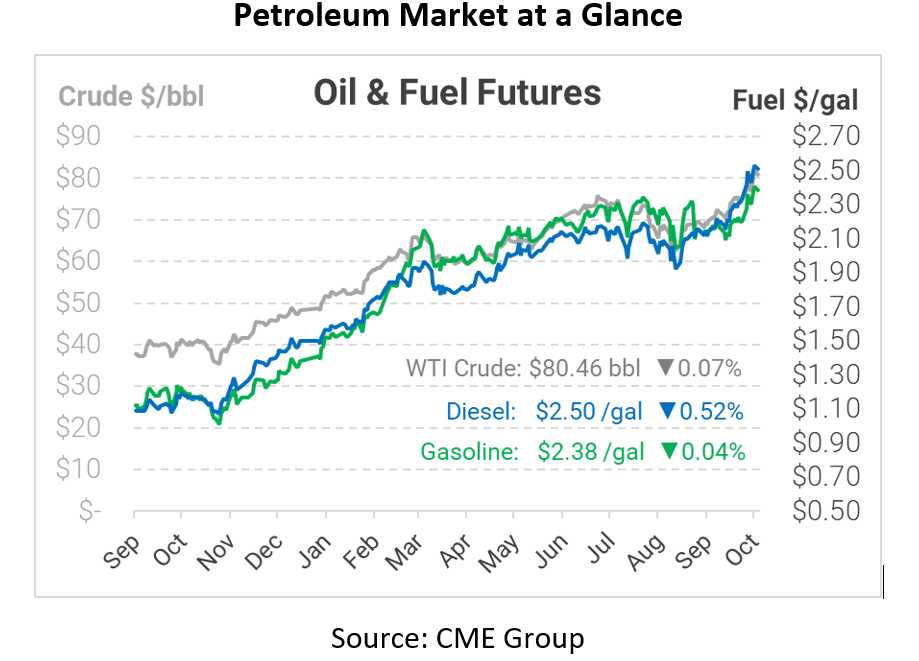

As oil prices rocket higher, JP Morgan is warning that “the sky is the limit” for distillate prices this winter if a bad winter storm hits the US. With prices already at multi-year records, the bank warns that the only way to prevent higher prices is demand destruction – which isn’t exactly an option for consumers in cold climates who rely on heating oil to warm their house or business. Explosive natural gas prices have already led some to switch to oil, contributing to rising fuel costs. Diesel prices are currently around $2.50, which over the past 15 years is higher than 72% of the time. Historically, diesel prices have sloped upward quickly from the $2.30/gal level, suggesting that further increases could be quick and dramatic if they occur.

Eighteen months ago, OPEC+ went to great lengths to stabilize the oil market, cutting their total output by nearly 25% to keep oil prices from collapsing. Although consumers appreciate low prices, this action was largely applauded at the time even in the US, since it kept US oil companies afloat (even if they suffered some extreme hardship along the way). Now, however, the organization is taking its time returning supply to normal, adding just 400 kbpd (or 0.4% of global supply) back each month between now and 2022. That slow and cautious approach may keep all fuel markets moving higher towards the end of the year.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.