Is Peak Fuel Demand Near?

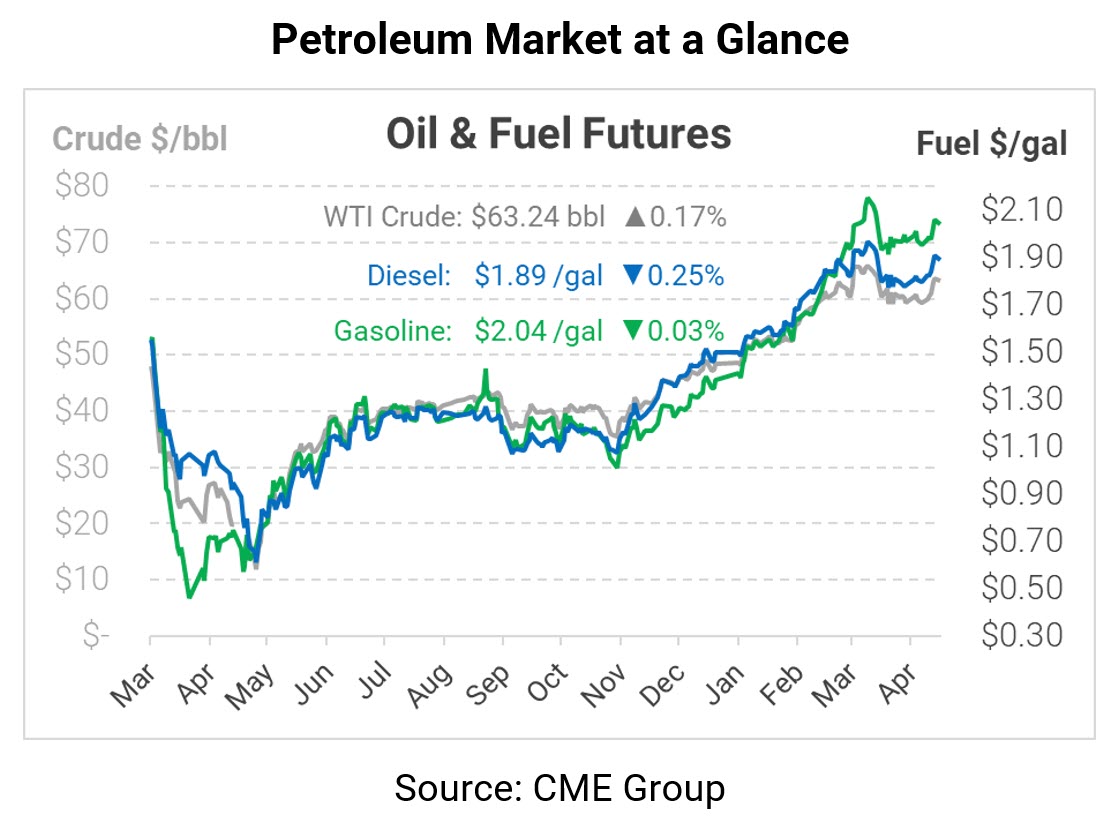

The oil complex remains flat this morning following last Wednesday’s $3/bbl rally; WTI crude has traded close to the $63/bbl level for four consecutive sessions. Gasoline remains above $2/gal, while diesel prices are hovering around $1.89. COVID cases continue falling in the US but rising elsewhere, keeping markets in limbo until vaccine programs gain traction in developing countries. Although there’s few headlines driving markets today, there’s still plenty of on-going analysis worth tracking.

Goldman Sachs is forecasting peak transportation oil demand in 2026, a year sooner than their previous reports. Other agencies have made similar predictions; Wood Mackenzie recently reported that transportation demand could peak in 2023 if countries focus aggressively on climate legislation. BP noted last year than oil demand may have already peaked!

On its face, declining oil demand is good for consumers – less demand means lower prices. Goldman Sach’s report, though, notes that while transportation demand will soon peak, overall petroleum demand may continue growing for years. On-road fuels make up just 43% of total oil demand, with petrochemicals making up a significant part of the remainder. Petrochemical demand gains will keep crude demand (and prices) afloat. Since crude prices make up over half of fuel prices, and taxes and fixed transportation costs account for another 20-30%, the benefit to diesel and gasoline consumers will be small. Crack spreads may decline slightly as petrochemicals take over, but crude prices will continue to drive fuel costs.

In regional news, Canada is lobbying the US to keep the Enbridge Line 5 pipeline operational. The pipeline transmits 500 kbpd of crude oil from Canada into Michigan and through to Sarnia, Ontario. At issue, the pipeline runs through the Straits of Mackinac, which connects Lake Michigan and Lake Huron. Michigan Governor Gretchen Whitmer has tried closing the pipeline, pointing out the risk of oil spills in this area disrupting wildlife and commercial activity. Trudeau’s government has reportedly reached out to several levels of America’s government, including President Biden, to advocate for the pipeline. Enbridge is building a tunnel around the pipeline in sensitive areas, which they claim is in line with President Biden’s infrastructure goals. For consumers, the pipeline provides important crude supplies to local refiners, so its shutdown would necessitate thousands of long-hauls daily from outside markets.

This article is part of Daily Market News & Insights

Tagged: Canada, Crack Spreads, Enbridge, fuel prices, Peak Demand

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.