Iran Threatens Nuclear Program if Sanctions Continue

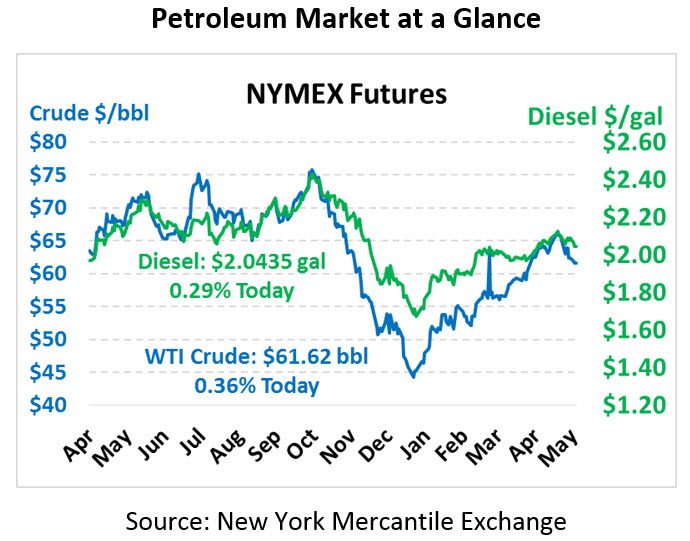

Oil saw continued losses yesterday after hefty gains on Monday, keeping crude roughly flat for the week. Crude oil is trading up this morning at $61.62, a gain of 22 cents.

Fuel is mixed but relatively flat this morning. Diesel is trading at $2.0435, a fractional gain of 0.6 cents. Gasoline is trading at $1.9461 a fractional loss of 0.3 cents.

The API released their weekly numbers yesterday afternoon, showing trends roughly in line with expectations for the week. Crude oil saw a moderate build, while gasoline and diesel inventories fell. This is a common theme when refinery utilization is low, as it’s been for the last several weeks. Refineries use less crude oil, but also cause suppliers to rely more heavily on fuel inventories. The EIA’s data later today will confirm whether the API’s numbers are directionally correct.

In international news, Iran claims that they are close to working out an agreement with the EU to allow some trade to continue. It’s a tough situation for the EU – Iran has committed to resuming nuclear activity if countries comply with American sanctions, putting pressure on countries like China and EU nations to continue their purchases. Any trade between Iran and other countries cannot include cash exchanges, but could work on some type of barter system or with a non-Iranian holding company maintaining cash-flow on Iran’s behalf. Whatever happens, expect instability in oil prices as markets trade the headlines until more facts develop.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.