Inventories Follow Seasonal Pattern

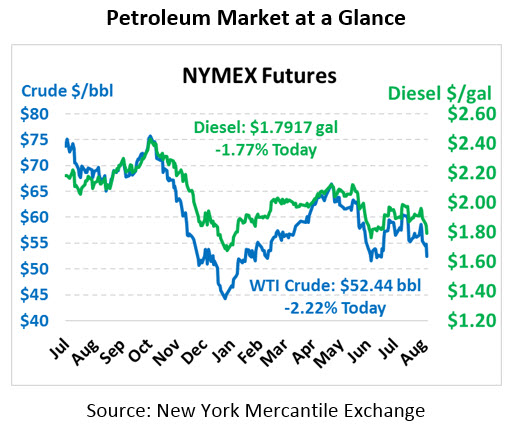

As the trade war with China continues to cast a shadow over the markets, oil prices are trading lower this morning. WTI Crude is trading at $52.44, a loss of $1.19.

Fuel is also trading lower today. Diesel is trading at $1.7917, a loss of 3.2 cents. Gasoline is also lower this morning, trading at $1.6630, down 2.4 cents.

The API’s data last night was generally in line with market expectations, finally giving us a glimpse of post-Hurricane Barry statistics. The report reflected normal trends for this time of year. Refineries are working hard to keep up with summer gasoline demand, causing crude stocks to fall. Gasoline inventories are also whittled down by the heavy consumer demand. Diesel is the by-product, rising seasonally as refiners focus on meeting gasoline needs. Come winter, the dynamic will flip – refiners will prioritize meeting diesel demand, and gasoline stocks will rise.

The EIA released their updated Short-Term Energy Outlook report which gives a view on the coming year of energy trends. Data showed US crude oil production dipping slightly to 11.7 MMbpd, down 0.3 MMbpd relative to June levels in response to Hurricane Barry. Despite the overall drop, onshore output (unaffected by the storm) rose by 0.1 MMbpd. The group expects oil production to continue rising to average 12.3 MMbpd for 2019 and 13.3 MMbpd in 2020.

The STEO also highlighted an average Brent crude price of $64/bbl for the remainder of 2019, slightly lower than the first half of the year. They also forecast continued narrowing of Brent-WTI spreads. Over the past year, the different between US WTI prices and international Brent prices has been closer to $8/bbl or more; today that has fallen to just over $5/bbl. The EIA expects that spread to remain in the $5.50 range over the next year as the US builds its export capabilities.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.